Shadow Exchange - High APR Liquidity Pools

1 comment

Although I'm mainly active on the HyperEVM, Sui, and Solana networks, there are some protocols on other chains that are too good to be missed.

on Sonic is one.Shadow is a concentrated liquidity exchange, meaning that when you provide liquidity, you get to choose the effective trading range to maximise your gains by capturing most of the fees.

High APRs

I'm currently using a very tight range of +/- 2% with the USDC/WETH pair. This means the price can move 2% up or 2% down, while still earning fees. If it falls out of the range, I need to rebalance or wait for the price to re-enter the range.

The APR can change quite a lot based on the current volume, but it's usually jumping between ~300% and 1,200%.

Rebalancing

With such a tight range, managing your position, rebalancing, is something we have to do pretty often. This means that when you are out of range, your position is now 100% in either asset, and you need to exit and swap it 50/50 again.

Compared to some other chains and their CLP protocols, exiting and entering positions are quite smooth operations on Sonic and Shadow. I've often read how people shilling Sonic keep telling how fast it is, and to be completely honest, it's pretty damn fast. Also, fees are somewhat tolerable on Sonic as well and with such an APR, those are covered in no time.

Rewards

Usually, if you provide liquidity in the USDC/WETH pool in any chain, you would earn fees in USDC and WETH, plus possible extra rewards. Shadow has a different kinda system and instead, we earn their native token, $SHADOW and currently, also Sonic's native token $S, in a wrapped $wS form.

These two are, of course, more volatile than ETH, for example, but if you feel uncomfortable holding these for too long, you can swap them to any other asset right away. No penalties, no lock-ups.

Then again, Shadow's 3,3 system and tokenomics are designed in a way that should theoretically reward long-term holders of their $SHADOW token. Moreover, if you stake your SHADOW, you'll receive xSHADOW, which earns you 100% of protocol fees, vote incentives, and penalties from other users' exits.

This also gives you voting rights that you can automate by using xSHADOW to mint x33, a token whose price increases over time versus SHADOW.

Airdrop Potential

The force isn't that strong with this one right now. Sonic just did their airdrop, and it's unclear to me whether Shadow has any plans to reward their user in the future.

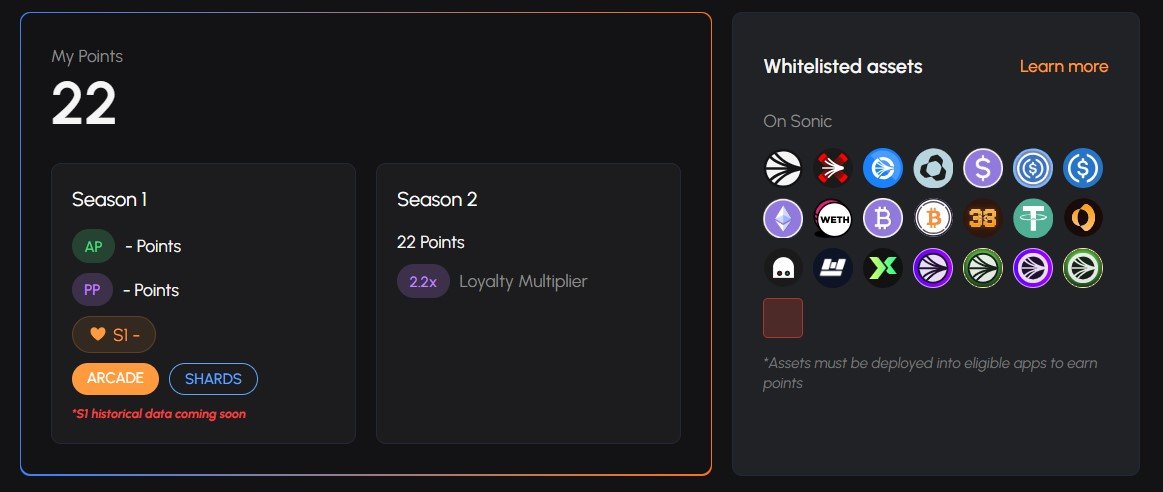

Still, Sonic has its points system ongoing with season 2 and unlike with the first season, where just holding assets earned us points, this time assets must be deployed into eligible apps to earn points. So yes, by providing liquidity on Shadow, we are also farming the Sonic Season 2.

Conclusion

All in all, concentrated liquidity pools with a stable side(USDC) and a volatile one(ETH) are a good choice when you are uncertain about which direction the market is going to take and if you believe there's gonna be choppy times ahead, where price bounces up and down. In times like these, volatility is our friend.

If I put aside all the points and the airdrop potential and focus solely on earnings, Shadow has the best returns compared to concentrated liquidity pools on Solana, Sui and HyperEVM, although it's pretty hard to make exact calculations because I'm using different deposit amounts and different ranges on each one of them.

This, combined with a very fast and smooth user experience, makes

a solid option. All you need is to stay focused, keep on monitoring your position, and rebalance when necessary.Thank you for reading, and don't forget to follow for more trading, defi, and airdrop content! 🟢👇

🔹

- the best perp DEX out there. Trade, stake & farm the next big airdrop!🔹 - New protocol! earn points by providing liquidity, we're still early

🔹 - Swap & provide liquidity on HyperEVM, earn points for the airdrop

🔹 - farm airdrop points with stables by entering ref code BRANDO28

🔹 - multi-chain, multi-wallet dex for all of your swaps

🔹 - stake SUI to earn APR & airdrop points!

🔹 Pawtato Land - very useful SUI dashboard, earn XP for the airdrop by completing small tasks

🔹 - easy to farm an airdrop on Solana. Deposit USDC, earn APR % points

🔹 - concentrated LPs on Sui. Very good APRs!

Comments