A Look at the Decentralized Hive Fund DHF | Data on DHF Funds Added, Payouts Balance, and Top Accounts | August 2025

13 comments

The decentralized Hive fund plays a major role in the Hive ecosystem. It is the backbone for the development and funding of the platform. A tool that provides a self-funding mechanism for the chain! Since the creation of the Hive chain, its role has increased massively since there is no centralized entity that will keep developing. The community members are the ones making the development and the DHF is providing the funds.

The DHF has 23M HBD now. It holds 34M of HIVE as well but those are not available for use. Since the creation of the Hive blockchain in March 2020, a total of 83M HIVE were put in the DHF and later put in a slow conversion of 0.05% per day. After five years, 34M HIVE are left, but also the HBD balance of the hive fund has increased.

Let’s take a look at the data.

The account that holds the DHF funds is the @hive.fund. Only 1% of the HBD holdings in this account are available for daily payouts and funding. At the moment this budget is around 230k HBD per day. Projects can create proposals for funding and if they are voted out from the stakeholders, they will start receiving funds.

There is only one-way funds can exit this account and that is for proposal who have been voted from the community to get the funds.

When it comes to funding the DHF, or how funds are added to the DHF there is more than one way.

Funds added to the DHF:

- 10% share of the inflation

- Ninja mined HIVE conversions to HBD

- @hbdstabilizer

- HBD and HIVE transfers to the DHF

- DHF as posts beneficiary

The core source of funding for the DHF is the inflation.

In recent history a few more significant sources for funding were added. The most significant would be the HIVE that was transferred from Steemit Inc and co to the DHF. At the time of the fork in March 2020, there was more than 83M HIVE put in the DHF. In October 2020, this HIVE was put in a slow conversion mode with 0.05% of it being converted to HBD daily, that will continue for multiple years. This is to avoid price shocks. At the moment, there is 35M HIVE in the DHF now.

Another significant source of funds are the transfers to the DHF that are made by the @hbdstabilizer.

This account is receiving fundings for the purpose of stabilizing the HBD. It trades HBD or HIVE on the internal market to maintain the peg and then it sends the funds back to the DHF. Depending on the price of the HBD it sends back HBD or HIVE. When HIVE is sent to the DHF it is instantly converted to HBD at the feed price, making these funds available for use. The stabilizer sends and receives funds, but overall, it has been a net positive. It also acts as post beneficiary for the DHF.

Let’s check the charts.

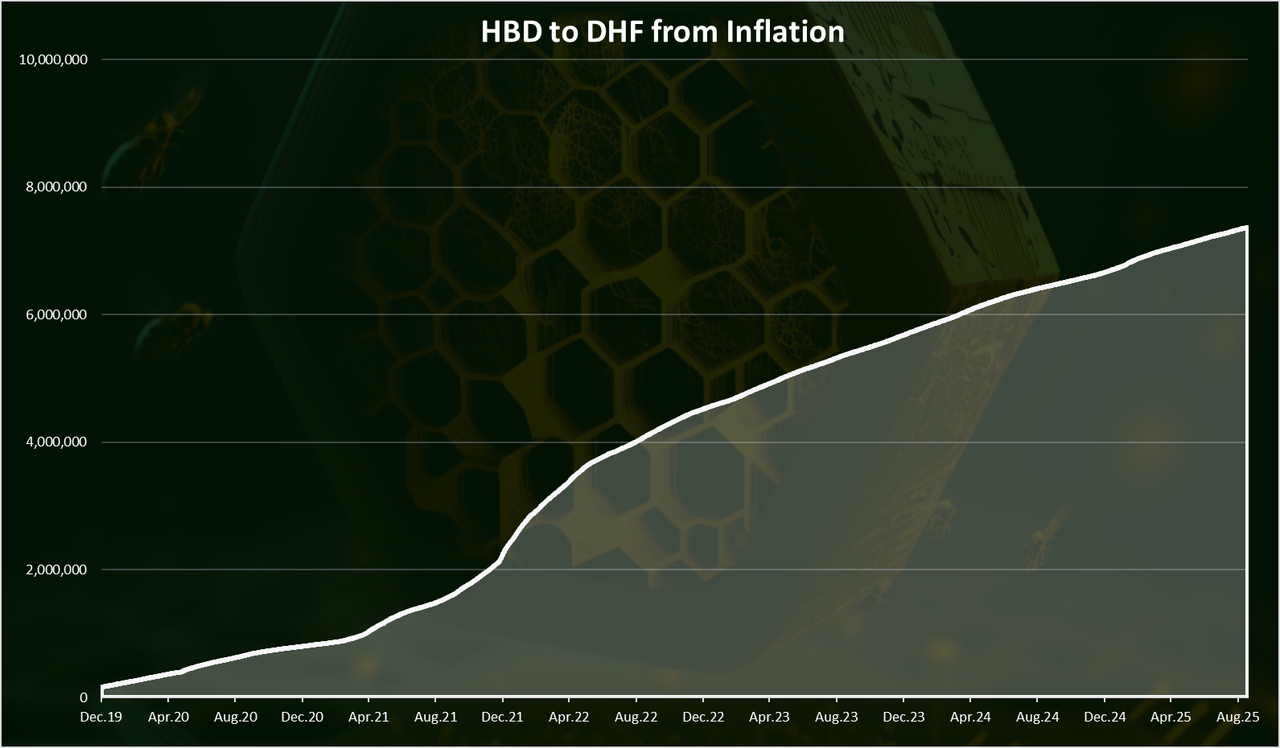

Funds from Inflation

As mentioned, 10% of the inflation goes to the DHF. Here is the chart.

The amount of HBD added in this way is correlated with the HIVE price. 10% in HBD is not the same when HIVE is 2$ or when it is 10 cents.

A total of 7.3M HBD was added in the DHF from the regular inflation. In 2024 alone there is around 1M HBD added in from the DHF from inflation, while in 2025 till now there is around 620k, so depending on the price, this year might end up similar as 2024.

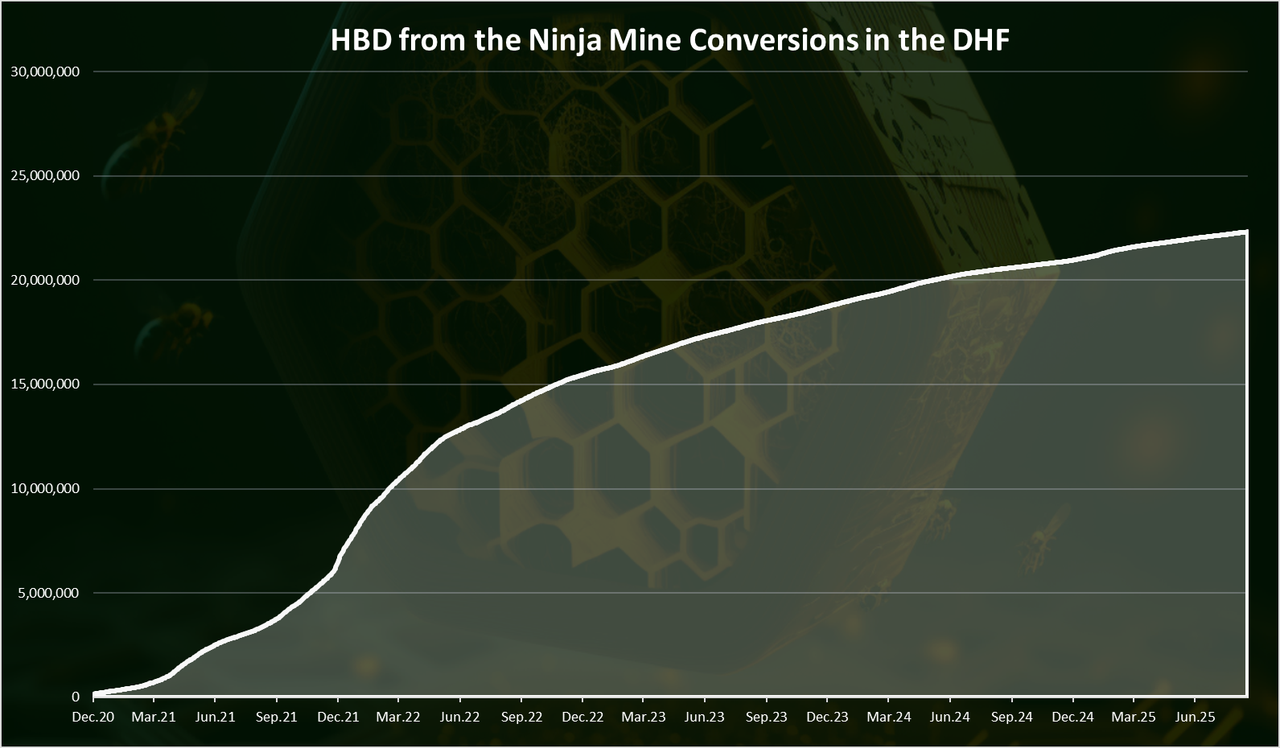

Funds from the Ninja Mined HIVE Conversions in the DHF

Here is the chart for the HBD added in this way.

This type of funding started at the end of October 2020. This is when the HF happened that enabled this. These conversions are also heavily dependent on the HIVE price.

A total of 22.3M HBD was added to the DHF from this source. In 2024 this number is at 2M, while in 2025 we are at 1.1M, so by the end of the year, depending on the HIVE price, there will probably be less funds added than the previous year. This is understandable as the HIVE balance in the DHF keeps going down.

This type of funds will slow down going forward as the amount of daily HIVE converted to HBD is going down. When the conversions started there was around 44k HIVE daily converted and now we are at 17k HIVE daily converted to HBD from the ninja mine.

Another significant factor is the price of HIVE. Nevertheless, these funds are limited, and after a few years they will drop even more.

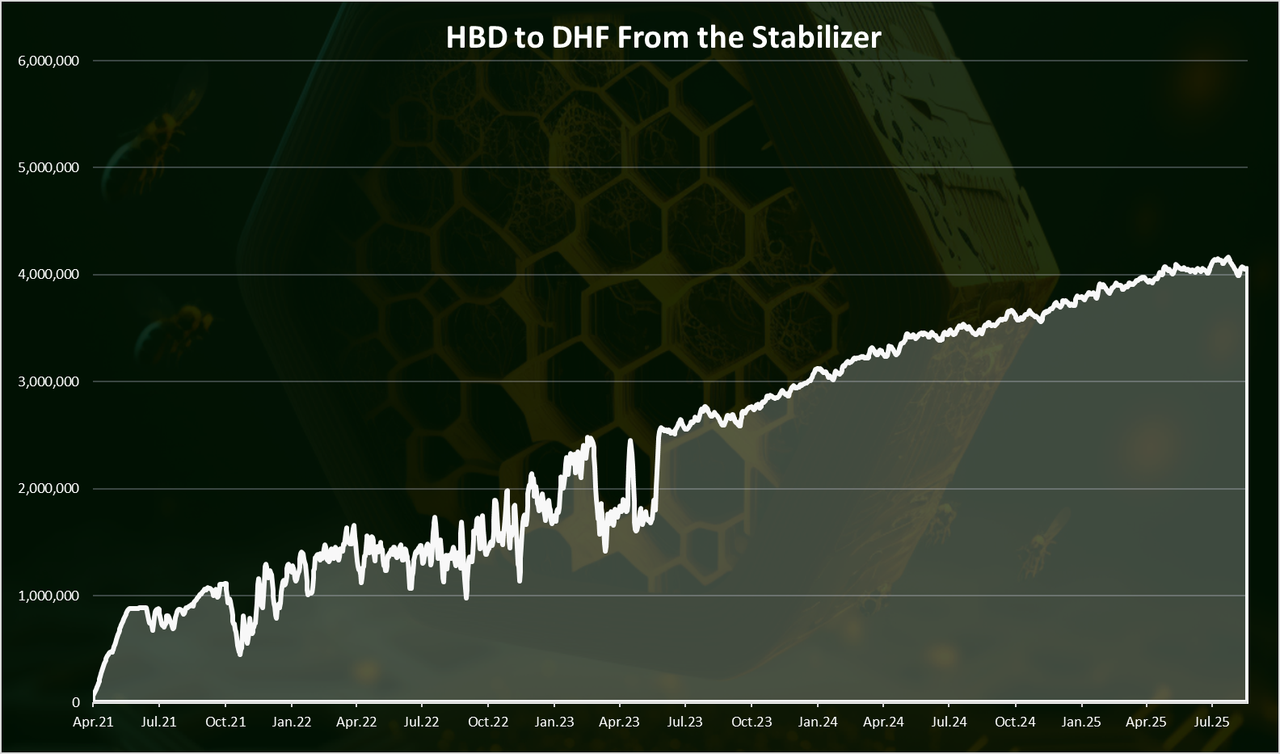

HBD Added to the DHF from the @hbdstabilizer

Here is the chart for the net HBD added in the DHF from the @hbdstabilizer.

As mentioned, the stabilizer receives HBD from the DHF, for the purpose of stabilizing the HBD peg.

If the HBD price is higher than 1$ then it will sell the HBD on the internal market. If the HBD price is lower than the peg, it will convert the HBD to HIVE and then buy HBD on the internal market.

If the price is at the peg, it will simply return the funds. It sends back funds to the DHF both, HBD and HIVE. The HIVE that is sent back to the DHF is instantly converted to HBD in the DHF to be available for use.

The chart above shows the net HBD added in the DHF from the stabilizer. A total of 4M HBD is added in this way in the DHF.

We can notice there has been some volatility in the year, with funds going up and down but in the long run they keep on growing.

When there are spikes in the HBD price, it usually marks a period when more HBD is added in the DHF, and when there are drops in the HBD price, the stabilizer is using more funds and is taking funds out of the DHF.

Note that the stabilizer also receives funds from posts payouts as beneficiary and this has been a significant amount lately since a lot of the top stakeholders allocate there votes there.

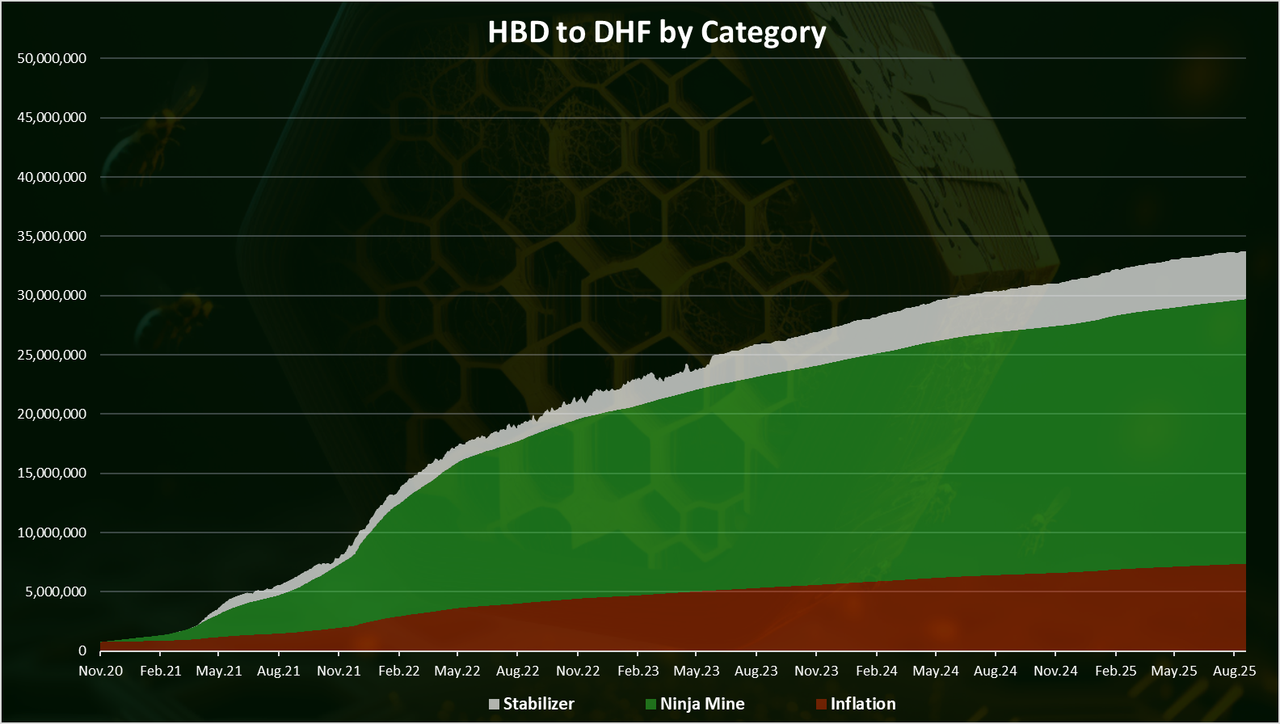

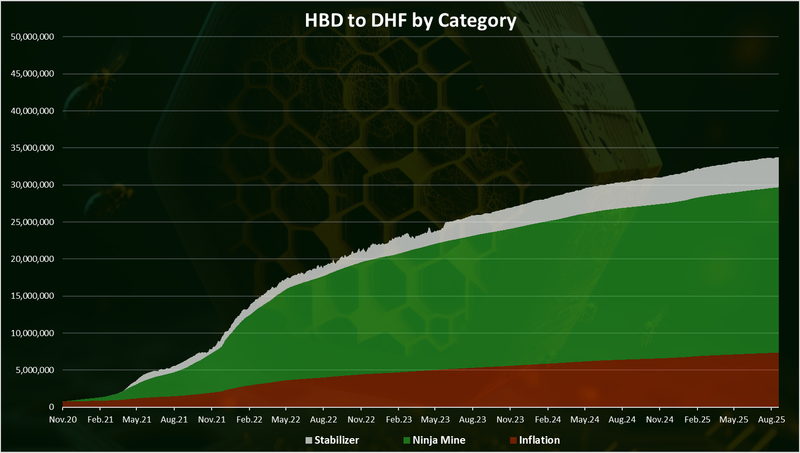

Cumulative HBD Added to the DHF

If we combine all the above, we get this.

From the chart above we can notice that the conversions from the ninja mined HIVE in the DHF are the main way for adding funds in the DHF.

A total of 22.3M HBD or 66% of all the funds in the DHF has been added in this way. The regular inflation is in the second spot with 7.3M (22%), and then the stabilizer with 4M (12%).

Going forward it is expected the funding from the ninja mine to drop, as those funds are limited and the regular inflation to increase its share.

Payouts from the DHF

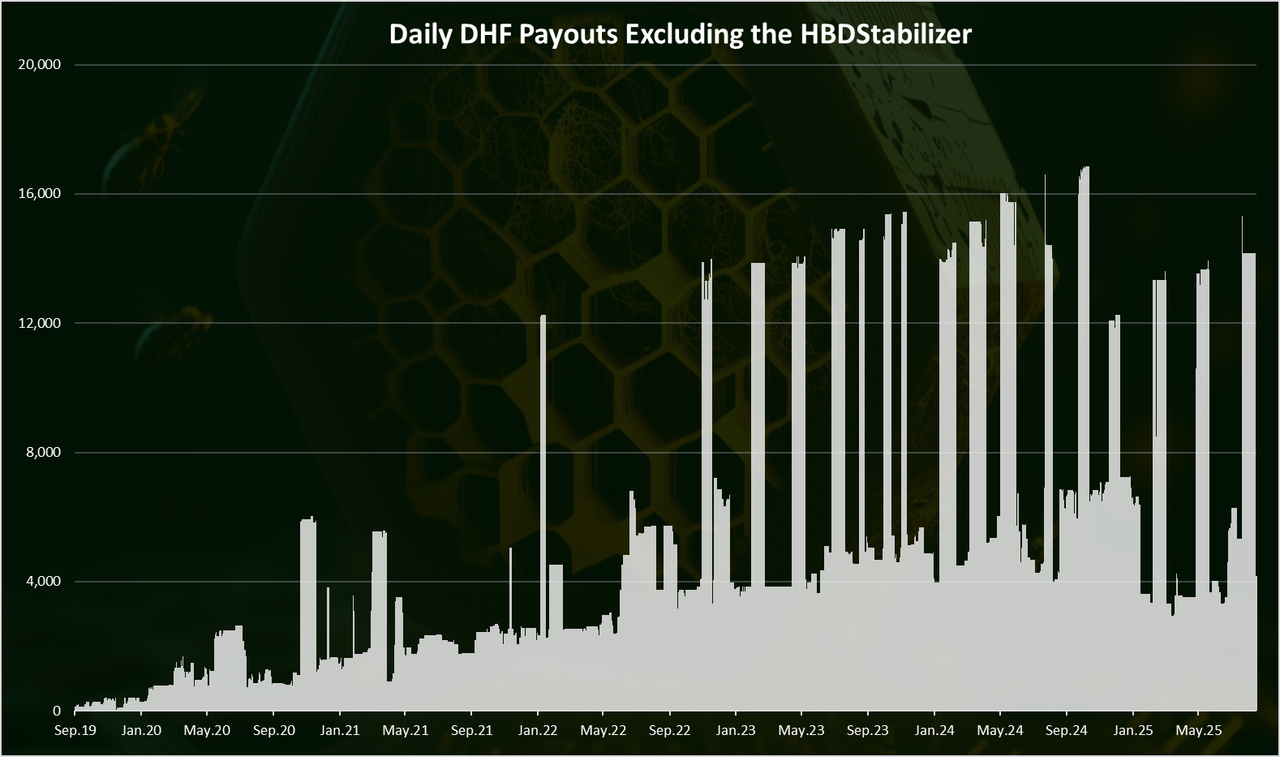

As mentioned, this is the only way HBD leaves the DHF. Here is the chart.

The chart above excludes the payouts to the @hbdstabilizer.

We can notice a few spikes in the payouts, usually when some project with heavy funding in a short period of time, like the valueplan.

On average in the last period around 7k HBD has been paid daily to DHF workers in 2025. The spikes that we can see on the chart are usually when the @valueplan account has proposal. This account manages a multiple activities under its umbrella.

On a yearly basis the total payouts look like this:

| Year | HBD |

|---|---|

| 2019 | 30,880 |

| 2020 | 616,784 |

| 2021 | 888,701 |

| 2022 | 1,775,947 |

| 2023 | 2,737,887 |

| 2024 | 3,393,126 |

| 2025 | 1,670,287 |

Note that 2025 is not over yet.

The funding to projects has reached an ATH in 2024 with more than 3M HBD allocated. This might seem a lot, but it is still a small number when compared to some other projects that have much larger development and marketing budgets. On the other hand, the market cap of HIVE has been struggling as well so I am not sure does this development funding is in line with the size of the chain. The regular inflation at the moment provides around 1M HBD for development yearly, while we are at 3M. This has been enabled by the HIVE in the DHF.

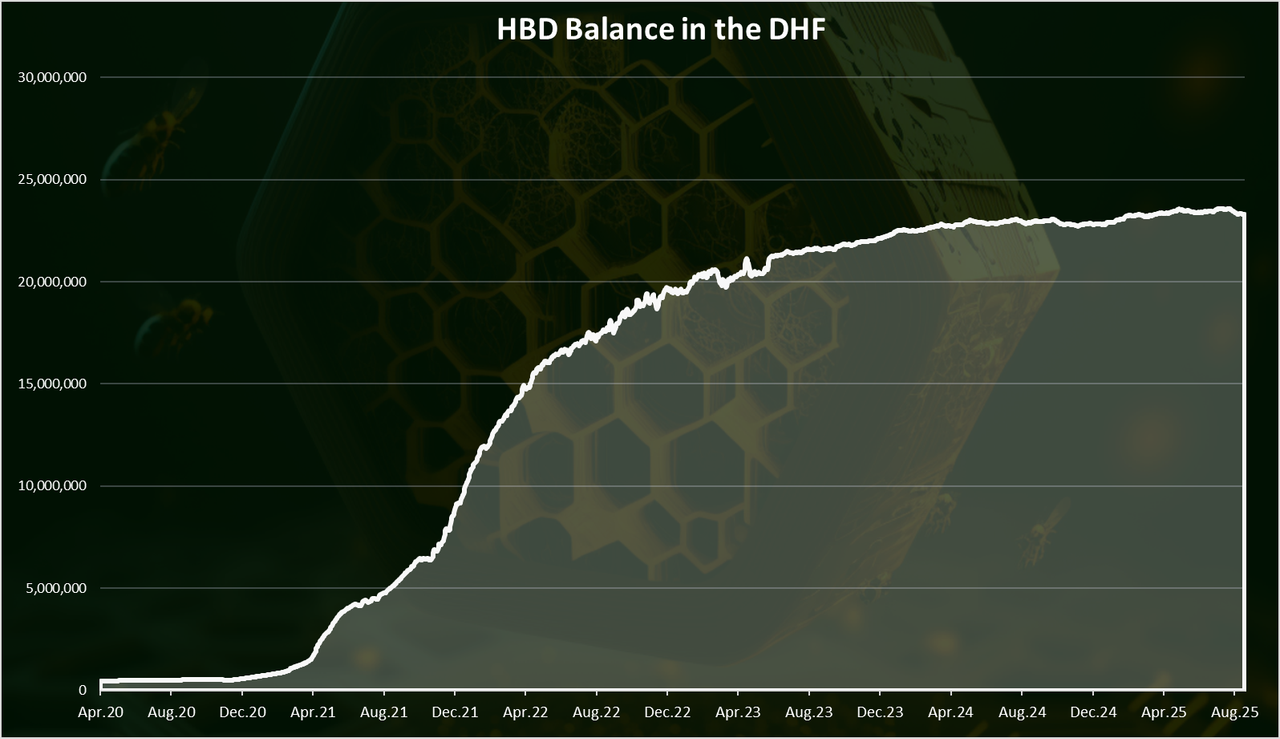

HBD Balance in the DHF

Here is the chart.

When we add the funds added and removed from the DHF we get the chart above.

A total of 23.4M HBD in the DHF now.

We can see the sharp growth in the funds back in 2021 and 2022. This is mostly because of the ninja mine HIVE to HBD conversions in the DHF and the high HIVE prices at the time.

Since 2023 up to 2025 this growth slowed down as HIVE prices have dropped and payouts increased.

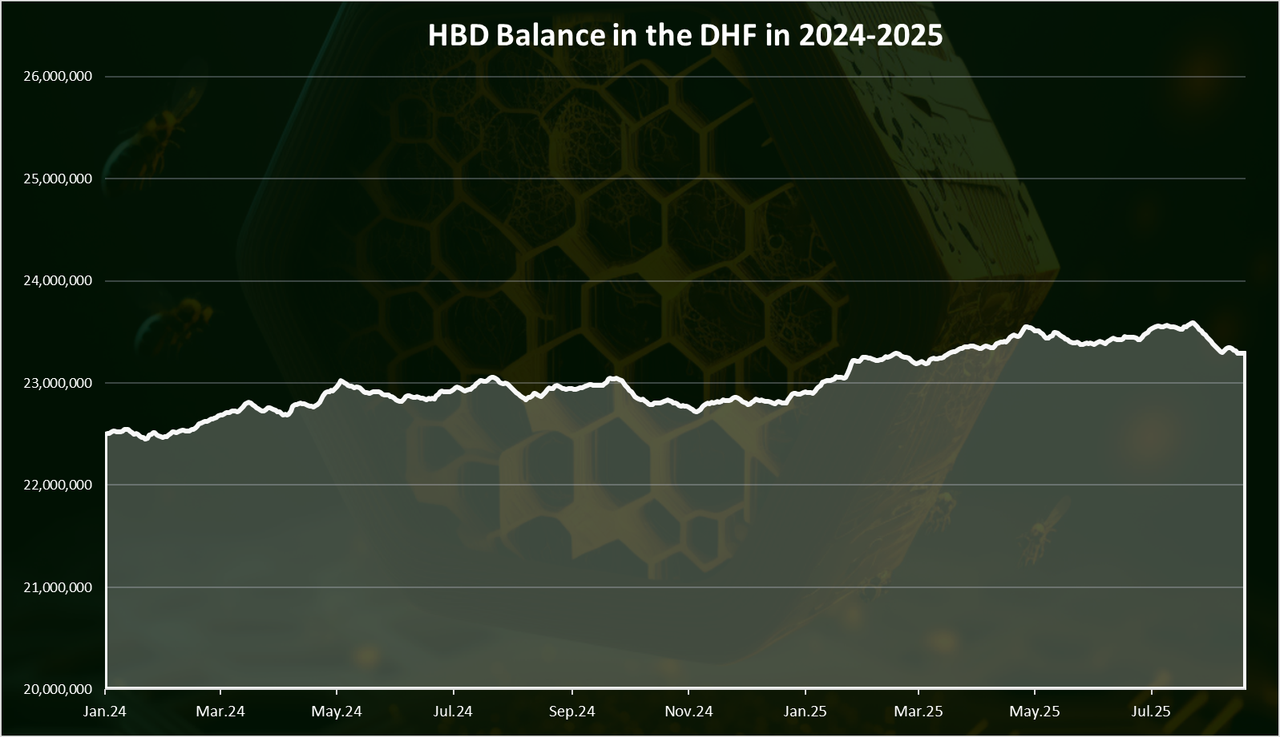

When we zoom in 2024-2025 we get this:

Somewhat flat situation with the HBD in the DHF in 2024 and 2025. Meaning the net inflow and outflow has been almost balanced. Although we can notice that overall, there is an increase in the period, starting from 22.5M in 2024 to 23.4M now, almost 1M more HBD added.

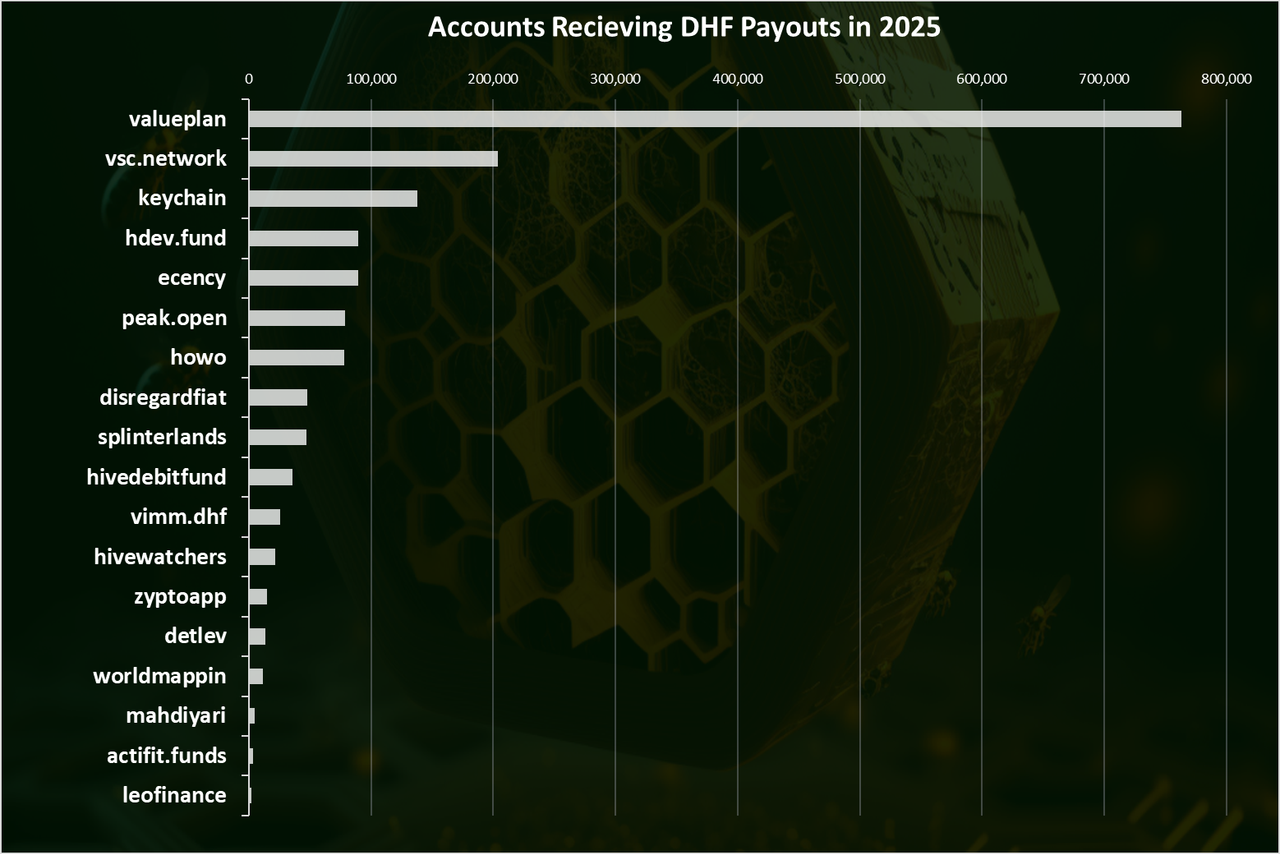

Accounts Receiving Funding from the DHF in 2025

A total of 20 accounts received funding from the DHF in 2025 so far.

Here is the chart, excluding the stabilizer.

The @valueplan is on the top for the first months of 2025 with 760k HBD, followed by @vsc.network and @keychain.

Other known projects in the top as @ecency, @splinterlands, @peakd, etc.

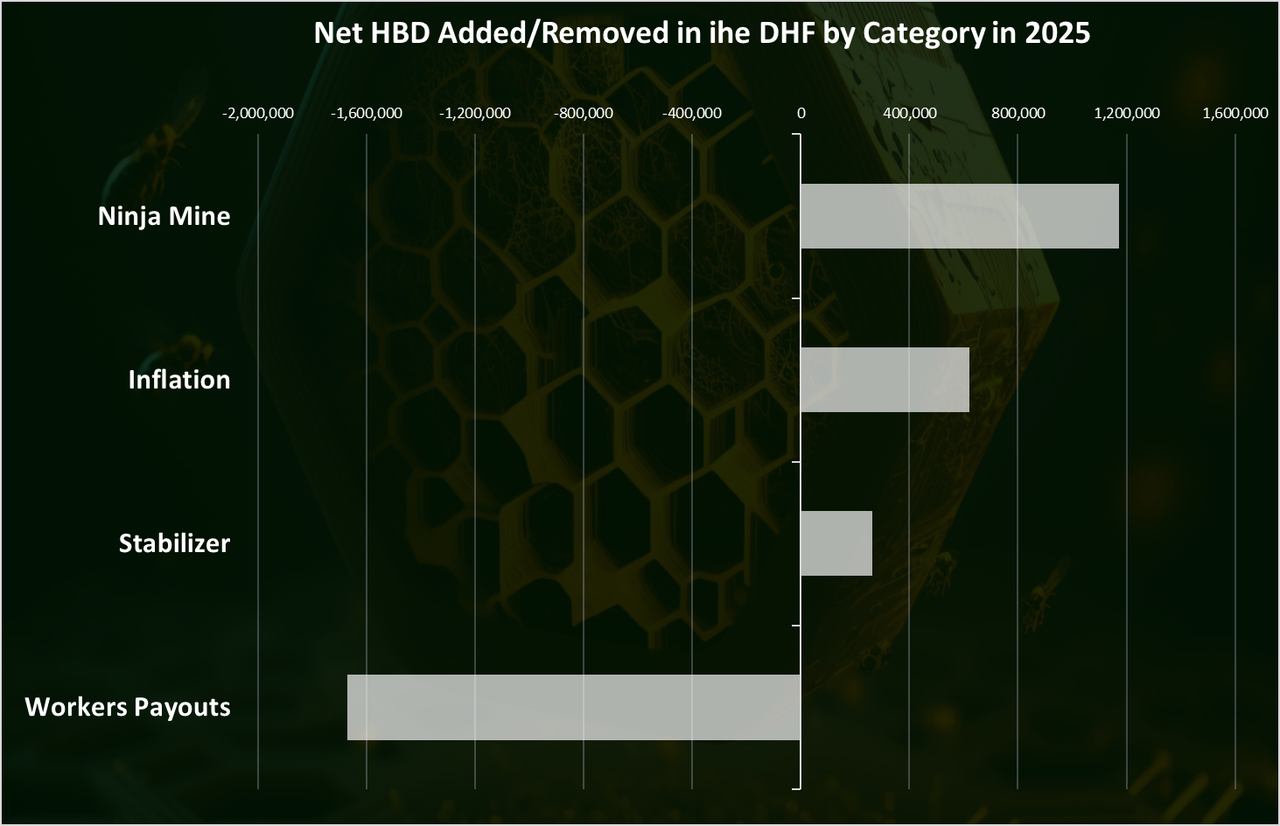

Summary for HBD Added and Removed in the DHF by Category in 2025

Here is the chart.

The Ninja mine conversions are at the top with close to 1.2M, the regular inflation is on the second spot with 620k, and next is the stabilizer with 260k HBD added to the DHF in 2025.

The payouts to DHF workers are at 1.6M up until August 2025 and are negative on the chart. A net 400k HBD was added to the DHF in 2025.

In summary, while the DHF’s HBD balance has grown to a significant 23M, growth has largely stalled in recent years. The apparent stability is mainly due to the continuous inflow of ninja-mined tokens; without these, the fund would have been shrinking, since regular inflation adds only about 1M HBD per year, while annual spending is closer to 3M.

The sustainability of new inflows depends heavily on the HIVE price. If HIVE appreciates, the DHF could expand and even support much larger spending, at levels seen on major platforms. However, at current price levels and market capitalization, the fund is operating at the edge. Still, the potential upside remains: if even one funded project succeeds, it could generate massive returns, effectively making the DHF operate like a VC fund.

All the best

@dalz

Live data on HBD here:

Comments