My New Position as Executive Chairman of LeoStrategy

9 comments

Hey Lions,

I have been a close observer of the evolution of Bitcoin Strategy companies. It has become an incredible fascination of mine to see the growth of MicroStrategy and the proliferation of other Strategy companies as the space has evolved. Whether you agree with the approach of relentlessly acquiring BTC on your balance sheet and raising capital to continually acquire more and more BTC, it has been working quite well.

The future of "Strategy" companies is simple: the ones who combine both a real business model with the continuous acquisition of BTC will succeed enormously. The fundamental requirements:

- They are able to have permanent capital when it pertains to the BTC on their balance sheet (they never have to sell to "cash out" investors, Warren Buffett pioneered this model of Permanent Capital with Berkshire)

- They have real revenue from some sort of business model that generates new capital to both cover any expenses + acquire more BTC

- They are able to leverage the BTC on their balance sheet to acquire more BTC in some sort of APR-accretive manner

My Position as Executive Chairmen

When LeoStrategy was being formed, a handful of LEO whales came together and said that what Michael Saylor is doing with MicroStrategy should be replicated for LEO. They formed LeoStrategy and the LSTR token for doing this.

They came to me asking if I would officially be a part of this. I offered advice but had no official role. I believe that LeoStrategy can succeed immensely if managed the right way and I have freely given my advice from conception to reality.

Recently, they asked if I would come on in an official capacity. For LSTR to succeed massively, they need to sell out their entire 100k LSTR offering to the market.

The recent changes in the LEO economy have made me think more on taking a hands-on approach to LSTR. I believe there is a ridiculous amount of potential with LeoStrategy and the LEO token and I know that I am capable of unlocking it. For all of us.

As of today, I have officially taken the Chairman position of @leostrategy and will guide the team to success. My salary for doing so is 0.00 LEO per year :)

LSTR's Modus Operandi

Let us begin with what LSTR is and should be. As I mentioned above, there are 3 fundamental requirements to the success of any Strategy company. Let us modify the asset from "BTC" to "LEO":

- They are able to have permanent capital when it pertains to the LEO on their balance sheet (they never have to sell to "cash out" investors, Warren Buffett pioneered this model of Permanent Capital with Berkshire)

- They have real revenue from some sort of business model that generates new capital to both cover any expenses + acquire more LEO

- They are able to leverage the LEO on their balance sheet to acquire more LEO in some sort of APR-accretive manner

Let us break down how LSTR achieves all 3 of these now and in the future:

- The initial raise of capital to purchase LEO off the market is via the LSTR sell wall. There are only ~82,000 tokens out of the total 100k tokens that were initially offered left for sale. Selling these out is essential as this is the base of permanent capital for the LeoStrategy vehicle

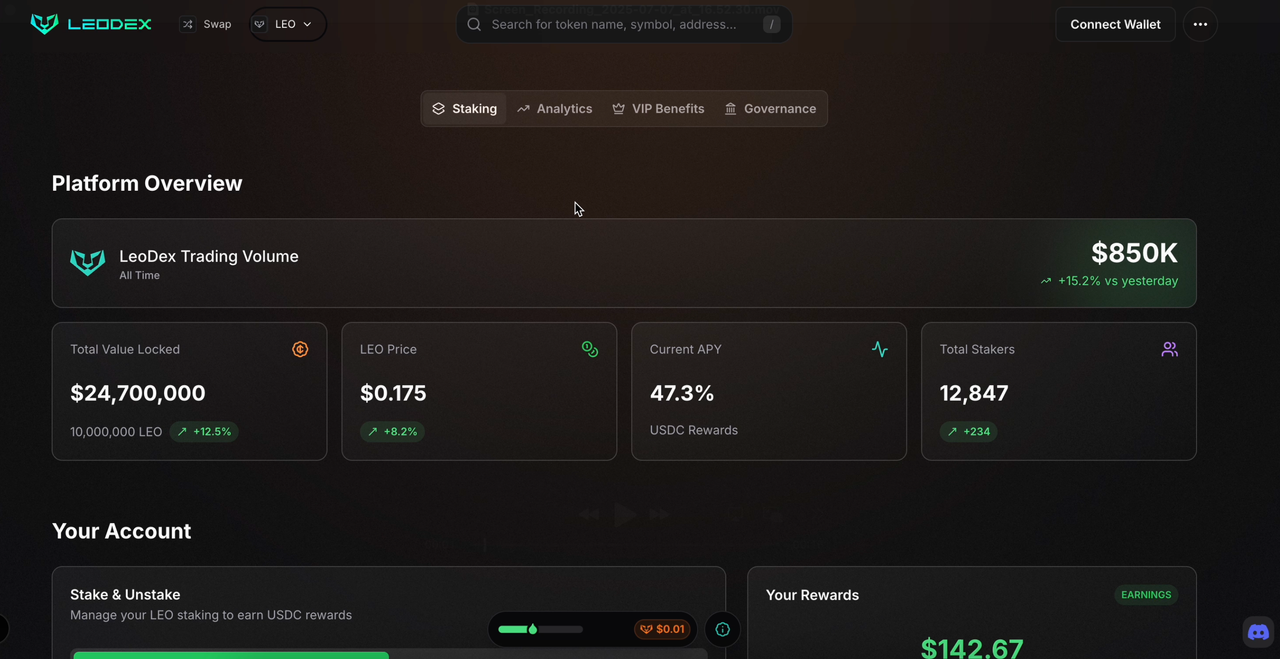

- Real revenue is to be generated in two key ways (potentially more in the future). 1). Posting on INLEO to earn HIVE/HBD/LEO. 2). Being active on X and sharing LSTR's referral code in order to acquire new users for LeoDex. This benefits LeoStrategy in two ways - it generates referral revenue from the referral share on LeoDex (30% of the total affiliate revenue generated on referred swaps) and it also increase LeoDex's total revenue which is a net positive for the LEO token - of which, LSTR's value is based upon. All revenue generated is used to buy more LEO and add it to the permanent capital base

- 100% of all LEO held by LeoStrategy will be staked as sLEO on Arbitrum. Staking sLEO on our new Arbitrum contract generate daily USDC rewards (100% of LeoDex affiliate fees are deposited to the sLEO contract and shared by all sLEO stakers). This generates accretive, daily yield for the @leostrategy fund. This yield is earned and used to buy LEO and stake it for more sLEO every day which means LSTR will continually earn more and more USDC each and every day to buy more LEO

Between these 3 means, LeoStrategy will hold a permanent base of LEO that continuously grows and can never be sold.

What's Next?

From my POV, I am guiding the LeoTeam to deliver on the Arbitrum staking contract + new sLEO page this week. We're also releasing over a dozen new updates to LeoDex (ICYMI, our team has been relentlessly grinding to make LeoDex the #1 DEX UI for cross-chain. We've already cracked the top 10 and are working our asses off to get to the top. Every day, the volume grows. We are currently doing ~$1M-2M per month in trading volume and it's climbing fast).

From the LSTR POV, we need to see the initial raise get fully committed. There are ~82,000 LSTR still on the market. I want to see all of these get sold out.

Selling this LSTR out completely will mean that LeoStrategy raises ~350,000 HIVE to buy more LEO. At current prices, this is nearly 3.5M LEO that LSTR will buy. It already holds nearly half a million LEO. This means that LSTR will hold close to 4M LEO after the initial cap raise.

4M LEO is the basis of permanent capital that we talked about. It will be moved to Arbitrum and staked as sLEO to earn USDC every day. 100% of the USDC it earns will be used to buy more LEO. Additionally, the other revenue methods of LSTR will buy more LEO each day.

Why Buy LSTR?

Great question. I think the faceless team put people off before. Now that at least my face is associated with it (and I am working to get others to become publicly-facing), hopefully it changes the dynamic.

Outside of this, LSTR is a leveraged play on LEO. If you own 1 LSTR, you can reliably predict it will be worth MORE in terms of LEO each year.

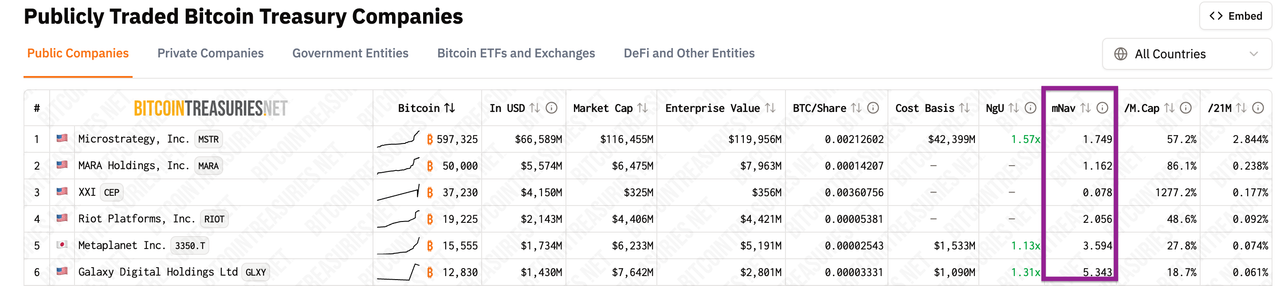

For Strategy companies, a metric called mNAV governs whether shares are at a premium or discount.

Right now, LSTR is trading at a 1.775 mNAV which means that LSTR is trading at an 77.5% premium relative to the LEO it holds.

How to Calculate mNav:

- Calculate the Market Cap of LSTR shares -> $0.925 × 17,942.226 LSTR outstanding shares (100,000 presale - already sold LSTR) = $16,596.55.

- Compute mNAV: Market cap / Total NAV = $16,596.55905 / $9,351.17 ($9,351.17 is the value of LSTR's total LEO hold≈ 1.775.

```mNAV = LSTR market cap / total LEO holdings in USD value``

(1.862 = 374,046.172 * 0.025 /

Now, LSTR is still in "presale" mode so using mNAV will become a lot more relevant once it is actually fully committed.

I expect this mNav to quickly flip to a discount which means that buying LSTR will effectively mean buying LEO exposure at a massive discount. This is how LSTR is priced in the future (once the permanent capital raise is sold out).

How will mNav flip?

- LEO price appreciation

- LSTR accumulating more LEO

- LSTR earning post rewards to buy more LEO

- LSTR staking sLEO and earning USDC to buy more LEO

When LEO hits $1, if the mNav of LSTR holds at 1.775, each LSTR share will be worth ~$37.09. That's without any premium expansion (if you study BTC strategy companies, premium expansion when the underlying asset - BTC - (or LEO in our case) is exactly what happens. This is how the leveraged ETF play on LEO becomes reality. You buy LSTR to get leveraged upside to LEO's appreciation.

LSTR selling out it's presale to gather this permanent capital while LEO is still cheap is vital.

What I expect to happen: LeoStrategy sells this out, LSTR goes on to be priced by the market based on mNav. It's generating yield every day from sLEO holdings + the revenue-generating model of Referrals/Post Rewards. Every day, it acquires more LEO while the price of LEO appreciates. The mNav is regularly at a discount which causes buying activity and ultimately leads to an mNav premium (exactly how MSTR played out).

Adding LSTR to the LeoDex Site

Now that I've taken over the reins, we may add LSTR to the /leo page on LeoDex. This will allow us to track the mNav in real-time and also advertise LeoStrategy to the world of cross-chain.

Time to Take LEO to New Heights and LSTR is a Vehicle for Helping With It

I believe LSTR will become a massive value creation engine for LEO. They work hand-in-hand to generate value for our ecosystem.

To make this reality, we need to see LSTR's permanent capital base fully committed. I am open to your feedback on how we can make this happen.

IMHO, one day LSTR will trade at a massive premium on the LEO it holds. We've seen this for other Strategy companies and LSTR is even better positioned because of the revenue-generation economy built around LEO. All that needs to happen is for LSTR to stake sLEO + generate referral income and we'll see the NAV skyrocket over time.

Buy LSTR ->

Posted Using

Comments