From Worst to Second Best | DeFi Journey #22

2 comments

Well, I was saying

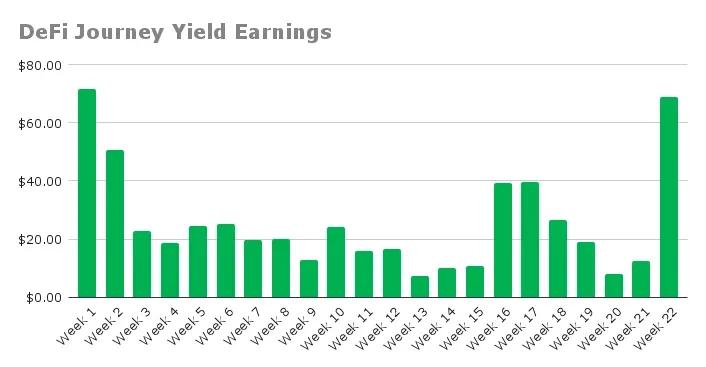

and then this week switches to the other extreme. This week I yielded my second highest yield since I started writing and tracking my DeFi journey. This week I farmed $68.99 in yield, which is the second highest only to be beaten by my first post back in late January/early February when I farmed $71 in yield. So, what changed so drastically from the past week? Well, let us break it down.Week 22 TLDR;

- Yields Farmed: +$68.99

- New Positions Entered: 4

- Positions Closed: 4

- Total Deposits: $6563.26

- Current Value: $6427.50

- Total Fees of Current Positions (excludes exited positions): $55.94

- Price Difference (Inc. Fees): -$79.82 (-1.22%)

Portfolio Overview

With crypto prices having a mean reversion where BTC reached $112K, ETH hit $3.4K, SOL touched $160, and BNB reached $730, this was one of the signals for me to exit out of my stablecoin yield farming positions. More importantly, the main reason for exiting stablecoin yield farming positions was that two of my leveraged stablecoin positions had swung to negative yields. If I continued in them, I would be losing money fast. Therefore, I exited all four stablecoin yield farming positions on Extra Finance, Euler Finance, Pendle Finance, and Kamino Finance. I have opened four new Concentrated Liquidity Positions (CLP) focused on single-side exposure to BNB, Pendle, WETH, and SOL.

Recap of Exited Positions

USDC/USDT0 - Euler Finance, Arbitrum

This was one of the leveraged positions that swung to negative returns, and with the high leverage (8.98x) I was utilizing, the negative yield was sitting at -60%. It was a no-brainer that I had to exit and pay my loan. At least I exited with a small profit as the final week's yield was $4.34.

- Final Yield: $4.34

- Total Rewards: $5.21

- Total Deposits: $1478.05

- Withdrawal Value: $1483.26

- P&L: $5.21 (+0.35%)

oUSDT-USDC - ExtraFI, Base Chain

Another leveraged position that swung to negative returns. Not as high as Euler Finance, but it was around -20%, so again, a no-brainer to exit the position. Luckily, I caught it and was able to at least exit with another small profit.

- Final Yield: $2.64

- Total Rewards: $11.13

- Total Deposits: $2104.30

- Withdrawal Value: $2115.43

- P&L: $11.13 (+0.53%)

SyrupUSDC/USDC - Kamino Finance, Solana

This position was another leveraged position, but it was still yielding a positive 11%. However, because SOL price had returned to my target price, I decided to exit this position and use the funds to open a new SOL CLP position.

- Final Yield: $0.50

- Total Rewards: $1.26

- Total Deposits: $825.60

- Withdrawal Value: $826.86

- P&L: $1.26 (+0.15%)

sUSDX - Pendle Finance, Binance Smart Chain (non-leveraged)

This was my only non-leveraged position and was yielding a 12% yield. Due to the crypto market price corrections, I wanted to get back into DeFi CLPs. I exited this position with a small profit and also farmed

.- Final Yield: $5.57

- Total Rewards: $5.88

- Total Deposits: $2101.65

- Withdrawal Value: $2107.53

- P&L: $5.88 (+0.28%)

CLP Yield Farming Strategies

CL60-WETH/USDC 0.3% - Uniswap, Base Chain

New CLP position opened farming WETH/USDC on Uniswap on Base chain. I opened the position with $2124.28 deposit and a 19.20% range ($3301.06 to $3999.75). This past week I farmed $7.92 in fees and current value is $2098.41.

- Date Entered: 2025-08-02 7:30

- In Range: Yes

- Range: $3301.06 to $3999.75 (19.20%)

- Weekly Yield Farmed: $7.98

- Total Deposits: $2124.28

- Current Value: $2098.41

- Current APR: 96.23%

- Price Difference (Inc. Fees): -$17.95 (-0.84%)

CL60-PENDLE/USDT 0.3% - Uniswap, Arbitrum

New CLP position opened farming PENDLE/USDT on Uniswap on the Arbitrum chain. I opened the position with $1522.95 deposit and a 30% range ($3.69 to $4.97). This past week I farmed $39.90 in fees and current value is $1445.92.

Why Pendle? Its

and with its ever-expanding ecosystem (Hype L1 onboarded this past week), I see this as a strong long-term play as crypto investors are looking for stablecoin yield farming strategies.- Date Entered: 2025-07-30 13:55

- In Range: Yes

- Range: $3.69 to $4.97 (30%)

- Weekly Yield Farmed: $39.90

- Total Deposits: $1522.95

- Current Value: $1445.92

- Current APR: 230.61%

- Price Difference (Inc. Fees): -$37.13 (-2.44%)

CL1-USDT/WBNB 0.01% - Uniswap, BSC

New CLP position opened farming BNB/USDT on Uniswap on Binance Smart Chain. I opened the position with $2093.06 deposit and a 20% range ($675.45 to $824.98). This past week I farmed $0.54 in fees and current value is $2088.52.

- Date Entered: 2025-08-03 11:40

- In Range: Yes

- Range: $675.45 to $824.98 (20%)

- Weekly Yield Farmed: $0.54

- Total Deposits: $2093.06

- Current Value: $2088.52

- Current APR: 39.15%

- Price Difference (Inc. Fees): -$4.00 (-0.19%)

SOL/USDC 0.04% - Orca, Solana

New CLP position opened farming SOL/USDC on Orca on Solana. I opened the position with $822.97 deposit and a 32.83% range ($150.48 to $203.53). This past week I farmed $7.54 in fees and current value is $794.65.

- Date Entered: 2025-07-30 14:50

- In Range: Yes

- Range: $150.48 to $203.53 (32.83%)

- Weekly Yield Farmed: $7.54

- Total Deposits: $822.97

- Current Value: $794.65

- Current APR: 81.83%

- Price Difference (Inc. Fees): -$20.74 (-2.52%)

Concluding Thoughts

What worked last week (leveraged stablecoin farming) became a liability this week due to changing market conditions. The $68.99 in yields shows what is possible, but the -$79.82 due to fees and crypto price decreases reminds us that DeFi is as risky as it can get. Looking ahead, I will be monitoring these CLP positions closely. If crypto prices continue to decline, some positions may go out of range, requiring rebalancing or closure. The goal is to capture as much fee revenue as possible while the positions remain active.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content:

|| || Medium || TwitterPosted Using

Comments