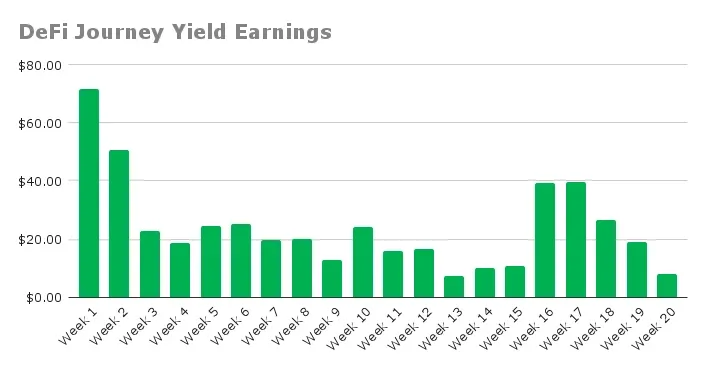

Leveraged Farming Enters | DeFi Journey #20

1 comment

This week, my DeFi yields continue to take hits as crypto markets surged, with BTC climbing past $120K and then coming back down and ETH breaking $3.7K. My last concentrated liquidity position (CLP) on Orca (Solana) finally went out of range after five months, dropping my fees to just $7.96. After

, most of my funds sat in low-yielding stables, so the drop makes sense.Portfolio Overview

With my only CLP position going out of range, I have decided to close it and locking in $60 in profit. However, I am sitting with nearly $4K in stables. So, while I wait for a market pullback, I have been researching and digging into leveraged yield farming over the past week. This strategy uses borrowed funds to boost position size in liquidity pools, chasing higher returns. It is a risky play as leverage can amplify gains but also losses fast, plus there are fees and borrowing caps to watch. I pulled all my USDC from Aave, Moonwell, and Extra Finance and jumped into two three times leveraged positions: one on Kamino Finance and another on Extra Finance. The remainder of the funds, I parked the rest in a Pendle LP, as everywhere I look on Crypto Twitter Pendle is the current darling. Depending on these leverage plays, I might shift my Hive HBD savings (earning a steady 15%) into these higher-return platforms, focusing on stablecoin farms at least for the short-term.

Recap of CLP Positions

CLP - SOL/USDC (0.04%) - Orca, Solana

My final CLP died as SOL broke $180, the top of my range. It was not a huge earner most weeks, but it finished with a $60.12 profit, which I will take and was active for almost five months.

- Final Yield: $5.48

- Total Rewards: $148.57

- Total Deposits: $917.14

- Withdrawal Value: $828.69

- P&L: $60.12

Yield Farming Strategies

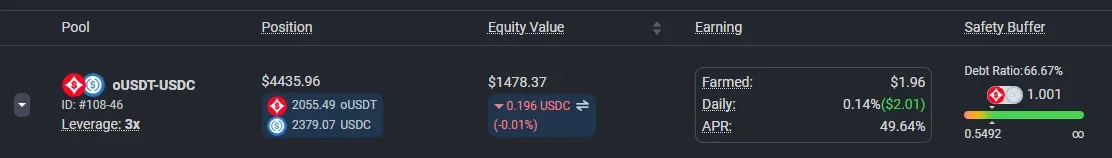

oUSDT-USDC - ExtraFI, Base Chain

New three-times leveraged position targeting oUSDT and USDC on Base Chain. Its currently yielding 56.3% APY, but the debt ratio sits at 66.67%, and liquidation is at 85%.

- Yield Rewards: $0.00

- Total Deposits: $1479.06

- Current Value: $1477.93

- Debt Ratio: 66.67%

- Leverage: 3x

- Price Difference (Inc. Fees): -$1.13 (-0.08%)

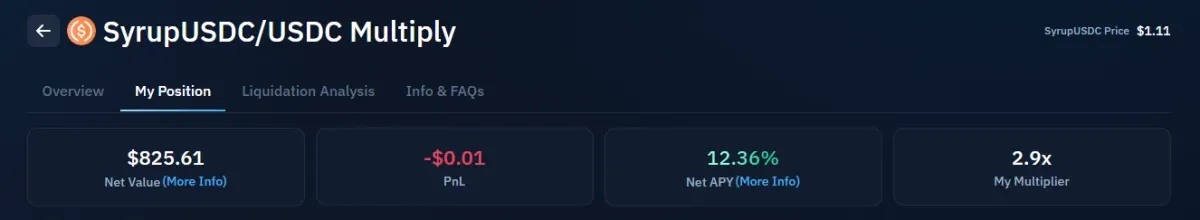

SyrupUSDC/USDC - Kamino Finance, Solana

Another three-times leveraged setup on Solana, farming SyrupUSDC/USDC. It is at 12.36% APY, with a 66.11% debt ratio and 85% liquidation threshold.

- Yield Rewards: $0.00

- Total Deposits: $825.60

- Current Value: $825.60

- Debt Ratio: 66.11%

- Leverage: 3x

- Price Difference (Inc. Fees): $0.00 (0.00%)

sUSDX - Pendle, Binance Smart Chain

This is my non-leveraged Liquidity Position on Pendle, staking USDX for a 13.52% APY via basis trade arbitrage.

- Yield Rewards: $0.00

- Total Deposits: $1369.11

- Current Value: $1371.61

- Price Difference (Inc. Fees): $2.50 (0.18%)

Concluding Thoughts

This week's $7.96 yield is low, but I am not sweating it. The crypto market's bull run has knocked my CLP positions hard, but I am not phased as it provided me a position to lock in profit on my SOL CLP position. With 70% of my portfolio now in leveraged farms and pendle, I am looking at risky plays with stablecoins. If the crypto market pulls back to $105K BTC or $2.5K ETH, this will be signals for me to re-enter CLPs with long-term holds like BTC or ETH.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content:

|| || Medium || TwitterPosted Using

Comments