Record Breaking | DeFi Journey #23

1 comment

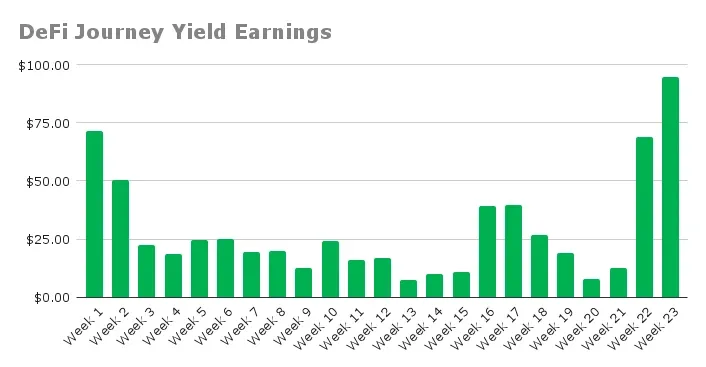

What better way to celebrate ETH breaking through $4.2K? Well, I have one way, locking in my best DeFi weekly yield since I started writing about my DeFi journey. This week I yield farmed $94.86 in yields. I'm still shocked that in almost a week, I nearly managed to farm $100 in yield. It's crazy how much can change in a week. Last week, I was getting back into CLP positions after yield farming stables for 2-3 weeks, to now almost yield farming $100 in yields. Let's get to it and break it down.

Week 23 TLDR:

- Yields Farmed: $94.86

- New Positions Entered: 5

- Positions Closed: 4

- Total Deposits: $6824.52

- Current Value: $7013.17

- Price Difference (Inc. Fees): $237.03 (+3.47%)

Portfolio Overview

As I reported

, this week I continued to yield farm single-sided CLPs focusing on BNB, Pendle, WETH, and SOL. Except for SOL, all these positions went out of the top side of the range with the price action of the crypto markets this week. As always, I waited for 48 hours to see if prices would come back in range before deciding to close the positions and lock in profit. Other times, I would rebalance and lock in impermanent loss, but as the market was running hard, I decided to exit the positions and lock in profits. I also came into funds from my Publish0x USDC payout, and as these funds were on the Optimism chain, I decided to put them to use there.Recap of Exited Positions

OP-WETH - Optimism

This small position was opened purely because I received a payout from writing on Publish0x, and as the payouts are in USDC on Optimism L2 chain, I decided to try some DeFi CLP positions. I opened this position, and then ETH went on a great run, quickly going out of range.

- Date Entered: 2025-08-05 8:15

- Date Exited: 2025-08-07 13:15

- Total Deposits: $12.19

- Exit Value: $12.19

- Weekly Yield Farmed: $0.33

- Price Difference (Inc. Fees): $0.33 (+2.71%)

CL60-PENDLE/USDT 0.3% - Arbitrum

Pendle went on a great run this week, as we saw many DeFi coins showing positive price action. This saw my CLP position go out of range, and I waited 48 hours, but with the Pendle price continuing to rise, I decided to close out the position and lock in a profit.

- Date Entered: 2025-07-30 13:55

- Date Exited: 2025-08-09 6:15

- Total Deposits: $1522.95

- Exit Value: $1578.06

- Weekly Yields Farmed: $27.38

- Price Difference (Inc. Fees): $122.39 (+8.04%)

CL60-WETH/USDC 0.3% - Base

ETH has finally started to come alive, and the past week saw the price crash through the $4.2K barrier. I knew this CLP position wasn't coming back into range for a while, so I decided to exit and lock in profit.

- Date Entered: 2025-08-02 7:30

- Date Exited: 2025-08-09 10:00

- Total Deposits: $2,124.28

- Exit Value: $2,212.48

- Weekly Yields Farmed: $26.61

- Price Difference (Inc. Fees): $122.73 (+5.78%)

CL100-WETH/USD+ 0.04% - Optimism

As I mentioned above, I opened another CLP position, and ETH went on a great run, which knocked another CLP position out of range. I locked in another small profit.

- Date Entered: 2025-08-07 13:15

- Date Exited: 2025-08-09 10:15

- Total Deposits: $12.52

- Exit Value: $12.68

- Weekly Yields Farmed: $0.28

- Price Difference (Inc. Fees): $0.44 (+3.51%)

CLP Yield Farming Strategies

SOL/USDC 0.04% - Orca

My faithful SOL/USDC stayed in range all week and I farmed $9.30 in yields. I also increased its deposit to $830.65 with the current value of $856.53 and a current APR of 66.89%.

- Date Entered: 2025-07-30 14:50

- In Range: Yes

- Range: $150.48 to $203.53 (32.83%)

- Weekly Yield Farmed: $9.30

- Total Deposits: $830.65

- Current Value: $856.53

- Current APR: 66.89%

- Price Difference (Inc. Fees): $42.76 (+5.15%)

CL1-USDT/WBNB 0.01% - BSC

This CLP position also stayed in range all week, and I farmed $18.67 in yields. I also increased its deposit to $2115.20 with the current value of $2155.98 and a current APR of 45.91%.

- Date Entered: 2025-08-03 11:40

- In Range: Yes

- Range: $675.45 to $824.98 (20%)

- Weekly Yield Farmed: $18.67

- Total Deposits: $2115.20

- Current Value: $2155.98

- Current APR: 45.91%

- Price Difference (Inc. Fees): $59.99 (+2.84%)

CL60-WETH/USDT 0.3% - Arbitrum

A new CLP position opened for farming WETH/USDT on Arbitrum. I opened the position with $1614.10 deposit and a 29.40% range ($3505.17 to $4703.11). This past week, I farmed $5.81 in fees, and the current value is $1,626.16 with a current APR of 90.95%.

- Date Entered: 2025-08-09 6:30

- In Range: Yes

- Range: $3505.17 to $4703.11 (29.40%)

- Weekly Yield Farmed: $5.81

- Total Deposits: $1614.10

- Current Value: $1626.16

- Current APR: 90.95%

- Price Difference (Inc. Fees): $17.87 (+1.11%)

CL2000-USDC/AERO 1% - Base

A new CLP position opened for farming AERO/USDC on Base. I opened the position with $2251.21 deposit and an 80% range ($0.85 to $1.88). This past week, I farmed $6.37 in fees, and current value is $2361.75 with a current APR of 80.38%.

- Date Entered: 2025-08-09 10:20

- In Range: Yes

- Range: $0.85 to $1.88 (80%)

- Weekly Yield Farmed: $6.37

- Total Deposits: $2251.21

- Current Value: $2361.75

- Current APR: 80.38%

- Price Difference (Inc. Fees): $116.91 (+5.19%)

CL200-USDC/VELO 0.3% - Optimism

This is the third CLP position I opened this week on Optimism with my Publish0x withdrawal funds. I opened the position with $13.36 deposit and a 40% range ($0.0525 to $0.0783). This past week, I farmed $0.11 in fees, and the current value is $12.89 with a current APR of 233.41%.

- Date Entered: 2025-08-09 10:25

- In Range: Yes

- Range: $0.0525 to $0.0783 (40%)

- Weekly Yield Farmed: $0.11

- Total Deposits: $13.36

- Current Value: $12.89

- Current APR: 233.41%

- Price Difference (Inc. Fees): -$0.36 (-2.69%)

Concluding Thoughts

Last week I had opened new CLP positions and was down $79, and this week I yield farmed almost $100 and locked in profits on several CLP positions. That's the incredible nature of the crypto markets when momentum is going. ETH breaking $4.2K was the catalyst that sent most my CLP positions flying. The key was recognizing when positions were going out of range and making quick decisions to lock in profits rather than hoping for a reversal. The strategy of waiting 48 hours before closing out-of-range positions proved effective. It gave enough time to see if the price action was temporary or if a sustained breakout was happening. In this case, the breakouts were real and sustained.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content:

|| || Medium || TwitterPosted Using

Comments