The Stealth Tax Hike....

4 comments

The Labour Party promised to end the freeze on income tax thresholds in their election manifesto by the 2028/29 tax year, however they've since refused to rule out keeping it in place beyond that date.

An extra year's worth of freeze could raise an additional £7 billion going into 2029/30.

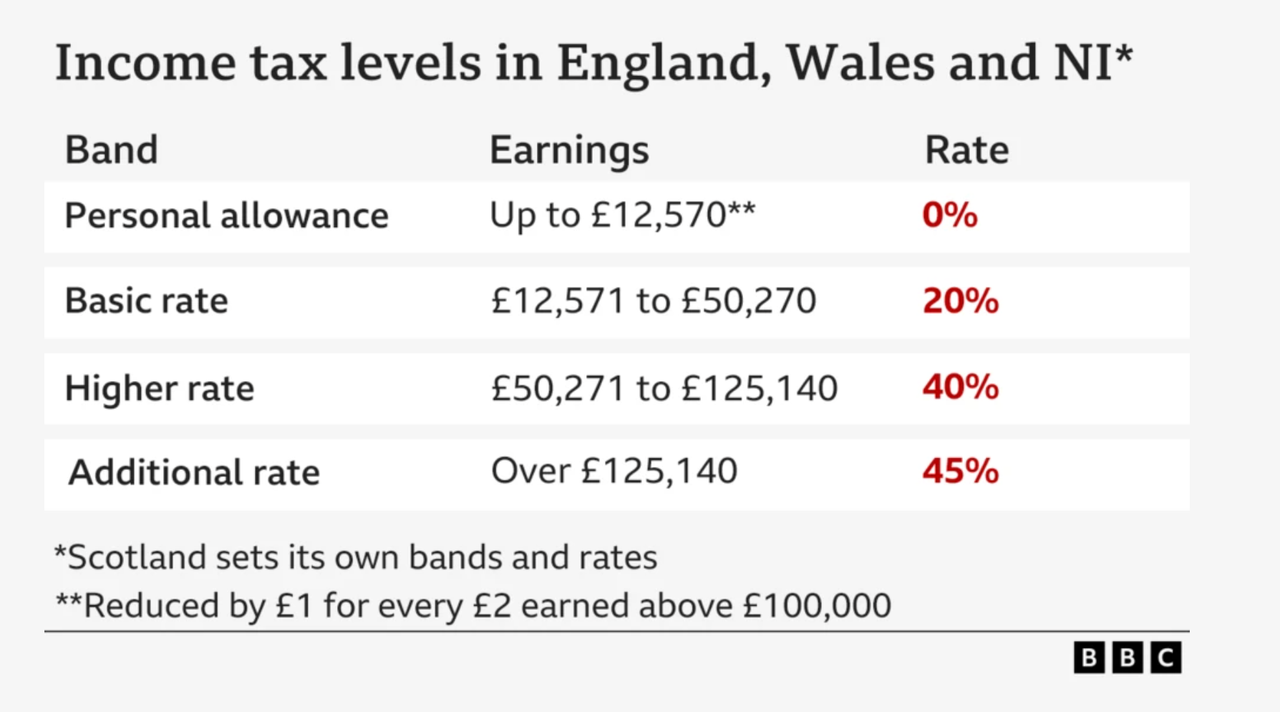

The UK's current tax thresholds look like this:

And the same applies to National Insurance thresholds.

This means that while inflation makes wages rise, the thresholds at which people begin to pay tax, or move into higher rate bands, do not shift. So more people pay more tax—even though their real income hasn't increased significantly.

Economists refer to this process as "fiscal drag." It is a subtle, because rates technically never increase and no new taxes are imposed. Instead, people simply pay more cumulatively.

This kind of policy, introduced by the Conservatives, is politically expedient, as the tactic avoids the wrath that typically accompanies direct tax hikes and can be packaged as maintaining the status quo.

--

A Risky Business...?

If the government does delay changing the threshold by another year then they miss out on a golden opportunity to offer voters a sweetener... there ain't nothing quite like an effective tax reduction policy to win votes.

And maybe that's about right too...the UK already has the highest tax burden in history, and this proposed freeze will only make that pressure worse.

It also has the perverse effect of putting people off working more in those middle-income brackets.

Such a tax freeze weighs most heavily on middle and lower income groups—those least able to shield themselves from rises in tax. A pay rise fueled by inflation can unintentionally place an individual in a higher rate band, erasing any actual increase. The result is a squeeze on disposable incomes when families are already under pressure from high cost of living.

Final thoughts...

To my mind it's surprising that more public uproar has not been levelled at this sustained stealth tax hike.

But as more and more workers feel squeezed, the indignation will grow. The longer the freeze, the greater the public outcry.

If the government is serious about tax transparency and equity, it may need to reconsider this sneaky tax hike. Fiscal prudence is necessary, but raising revenue in a way that hurts the average employee disproportionately can do lasting damage—to confidence in government and to growth.

Posted Using

Comments