Expert: “This Market Cycle Isn’t ‘Normal’ — Altcoins Are on the Rise”

1 comment

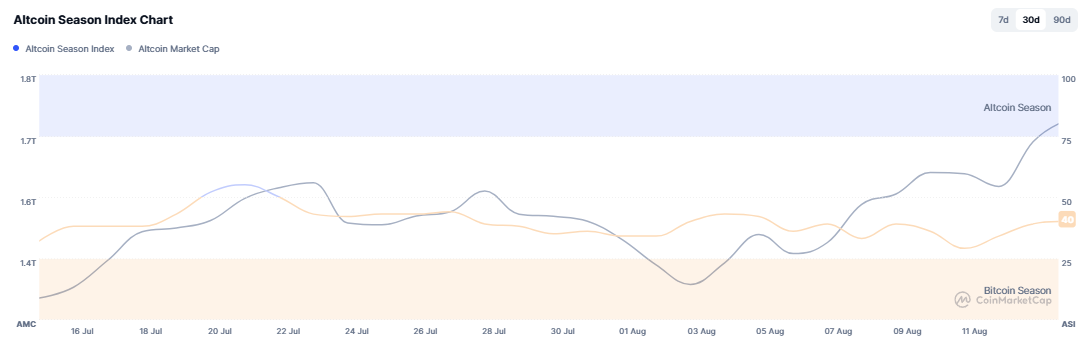

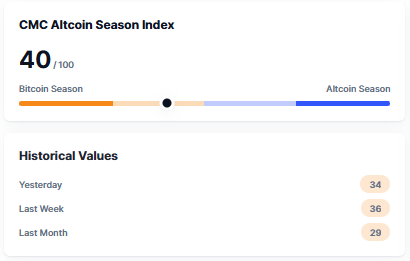

Bitcoin dominance has dipped to its lowest point in a month, shifting investor attention toward altcoins.

The dynamics of power within the cryptocurrency market appear to be undergoing a transformation, at least for the time being. In recent days, Bitcoin’s dominance (the proportion of total cryptocurrency market capitalization represented by BTC in comparison to other cryptocurrencies) has fallen to its lowest point in a month. Historically, when Bitcoin experiences a slowdown following a significant rally, altcoins—cryptocurrencies other than Bitcoin—tend to capitalize on this moment to gain traction. Although Bitcoin continues to serve as the foundational element of the market, altcoins can offer considerably higher percentage returns, rendering them particularly appealing to certain investors.

Source:

Crypto Funds Are Influencing the Market

For the last month, Bitcoin has been trading just under the $120,000 threshold, indicating signs of consolidation. Throughout this period, altcoins such as Ethereum, Solana, and Dogecoin have emerged as prominent players.

• Dogecoin has surged over 24% in the last week, currently trading around $0.25.

• Solana experienced a 23% increase over the week, with a trading price of $201.19.

• Ethereum stood out as the top performer, climbing nearly 30% to achieve a price of $4,690.

According to Gerry O’Shea, Head of Market Analysis at the investment firm Hashdex, this trend is not new: when Bitcoin pauses, other cryptocurrencies frequently capture the market’s focus. “This phenomenon is commonly referred to as altcoin season,” he remarks.

Nevertheless, O’Shea cautions that this instance may differ from previous cycles.

A New Type of Market Cycle

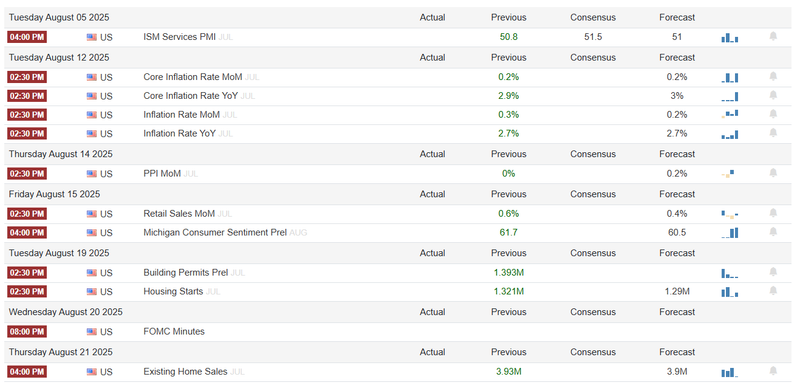

In earlier surges of altcoins, the narrative was often dominated by retail-driven excitement—whether it involved NFTs, memecoins, or the launch of new tokens. These periods resulted in astonishing gains, but they also concluded with equally severe downturns. The current market landscape appears different. The introduction of Bitcoin ETFs in the United States, along with the growing involvement of institutional investors—such as pension funds and prominent asset managers—has injected unprecedented capital and a level of stability into the market. Given that these institutions possess substantial amounts of Bitcoin, their participation may help maintain BTC’s price at a relatively stable level. This stability could restrict the extreme upward movements that altcoins have experienced in prior cycles.

Source: SMSF Adviser

From Speculation to Fundamentals

Another significant transformation is the shift in investor focus. Rather than solely speculative ventures, capital is now being directed towards blockchain ecosystems that offer real-world applications. For instance, the recent legislation regarding stablecoins in the U.S. and clearer regulations surrounding cryptocurrency have instilled greater confidence in institutional investors. Blockchains such as Ethereum and Solana—which serve as the backbone for stablecoins and decentralized finance—are directly benefiting from this regulatory clarity. As these platforms expand, they naturally encroach upon Bitcoin’s market dominance, thereby creating more opportunities for altcoins to excel.

A Temporary Transition — Yet Altcoins Are in the Limelight

Although this movement away from Bitcoin's dominance may be short-lived, the current momentum distinctly favors altcoins. Investors are closely monitoring projects that merge robust fundamentals with active user engagement. Nevertheless, O’Shea warns that Bitcoin’s position as the market’s anchor remains unaltered. The current cycle may not yield the same explosive altcoin profits seen in previous years—but in the near term, the focus is on Ethereum, Solana, and even established favorites like Dogecoin.

Source:

In Conclusion:

The market is undergoing transformation. With institutional investments providing stability to Bitcoin and new regulations enhancing significant altcoin ecosystems, this period does not represent a conventional "altseason." However, it is an opportunity for altcoins to excel—at least for the time being.

Comments