Why 'In-Kind' Redemptions Are the Real ETF Game-Changer

0 comments

While the crypto world celebrates the mainstream validation brought by Bitcoin and Ethereum ETFs, it's easy to focus on the price charts and the headlines. But often, the most profound revolutions don't happen on the glittering surface; they happen in the "plumbing"—the underlying infrastructure that makes the entire system work. A skyscraper is only as strong as its foundation, and for crypto ETFs, a critical piece of that foundation is finally being upgraded.

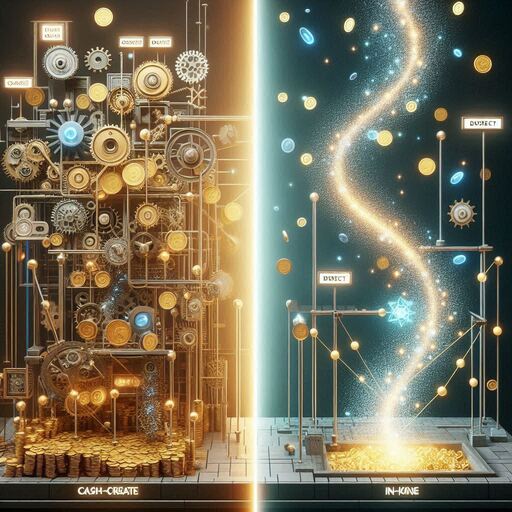

When the first spot Bitcoin ETFs launched, they came with a significant compromise: they were limited to a "cash-create" model. This meant that when an Authorized Participant (AP) wanted to create new ETF shares, they had to bring cash to the ETF issuer. The issuer would then take that cash and go buy Bitcoin on the open market.

The crypto space is built on the promise of efficiency and removing unnecessary intermediaries. The "cash-create" model, forced by initial regulatory caution, felt like a step backward—a relic of an older financial system bolted onto a new one. The true game-changer, long awaited by institutional players, is the approval of "in-kind" redemptions. This is the upgrade that aligns crypto ETFs with how the most successful ETFs in the world have operated for decades.

This process, while functional, is inefficient. It introduces time delays, transaction costs (slippage), and can create a drag on the ETF's performance, causing it to deviate from the actual price of Bitcoin—an issue known as "tracking error." It's like ordering a custom-built car, but instead of the manufacturer using parts they already have, they take your money and go shopping for each component individually. It's clunky and expensive.

So, what is the "in-kind" model? Let's go back to our car analogy. Instead of giving the ETF issuer cash, an Authorized Participant (who is a major financial institution) can now deliver the actual Bitcoin they already own directly to the issuer in exchange for a block of new ETF shares.

It's a direct asset-for-asset swap. This is profoundly more efficient for several key reasons:

- Reduced Costs & Spreads: It eliminates the need for the issuer to execute large trades on the open market, drastically cutting down on transaction costs and slippage. This saving is passed on to investors through tighter bid-ask spreads.

- Minimized Tracking Error: Because the underlying asset (BTC or ETH) is transferred directly, the ETF's holdings will almost perfectly mirror the index it's supposed to track.

- Enhanced Tax Efficiency: For the fund, swapping an asset for shares is typically not a taxable event in the way that selling an asset for cash would be. This is a massive structural advantage.

- Deeper Liquidity: This model is far more attractive to the large market makers who act as Authorized Participants, encouraging them to provide deeper liquidity for the ETF.

The approval of in-kind redemptions is more than just a technical tweak; it's a sign of the maturation of the crypto market. It's the sophisticated financial plumbing required to handle trillions of dollars in institutional capital.

This leads to a crucial question for the community: Now that the infrastructure is being perfected, what do you believe is the next major hurdle for institutional crypto adoption? Is it regulatory clarity on other assets, or is it the development of more sophisticated on-chain financial products?

Comments