LEO Staking to Go Live on LeoDex with USDC Rewards

1 comment

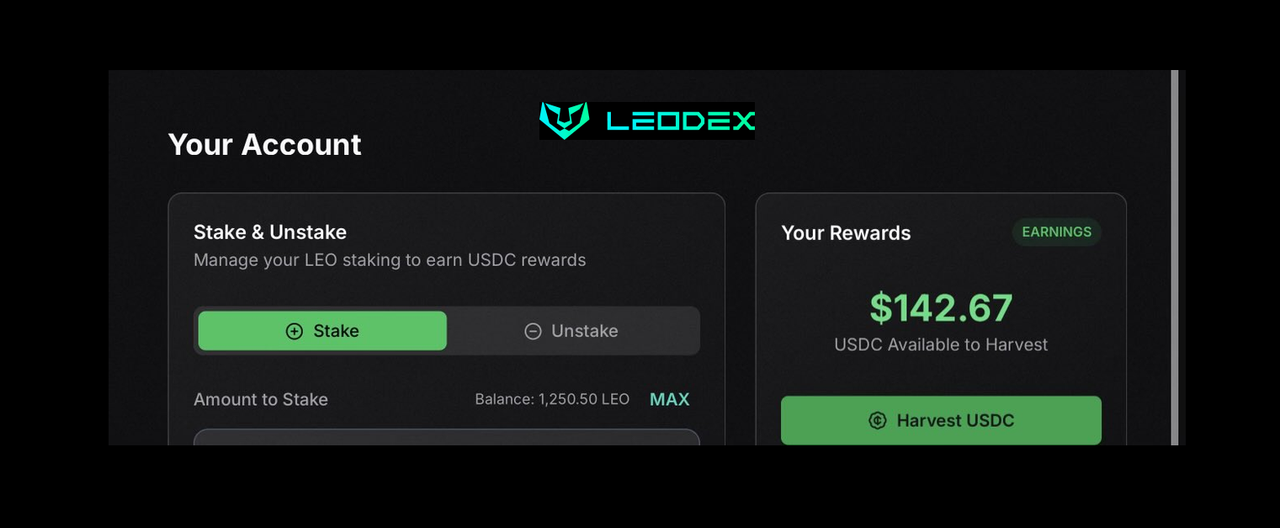

KEY FACTS: , a prominent decentralized exchange, is set to launch its LEO staking feature, following successful tests announced by Co-founder Khal Khaz, with 100% of affiliate fees distributed as daily USDC rewards, as showcased by a dashboard displaying $142.67 earned from a 1,250.50 LEO balance. Building on the "Protocol Owned LEO" (POL) strategy, which reinvests revenue to buy and stake LEO tokens, the platform leverages the Arbitrum blockchain’s scalability, processing over 1.5 million transactions daily in 2024, to enhance profitability.

Source: LeoDex

LEO Staking to Go Live on LeoDex with USDC Rewards

, a leading decentralized exchange, is preparing to launch its highly anticipated LEO staking feature. Announced by Co-founder Khal Khaz on July 16, 2025, the new staking system promises to distribute 100% of affiliate fees as daily USDC rewards to stakers, marking a significant milestone in the evolution of the LEO 2.0 ecosystem. With successful test runs completed and a live launch on the horizon, this development is poised to reshape the staking landscape on the Arbitrum blockchain.A New Era of Staking Rewards

The centerpiece of this announcement is the sleek staking interface. The image reveals a user-friendly dashboard under the "Your Account" section, where users can manage their LEO staking to earn USDC rewards. The interface displays options to "Stake" and "Unstake," with a current balance of 1,250.50 LEO available for staking. On the rewards side, users are greeted with an impressive $142.67 in USDC available to harvest, highlighting the potential earnings from this system.

Khal’s post emphasized that the affiliate fees generated by LeoDex will be fully allocated as daily USDC rewards, a move that underscores the platform’s commitment to rewarding its community. This follows the successful testing phase, which Khal described as "beautifully" executed, setting the stage for a seamless rollout.

Building on the Protocol Owned LEO Strategy

This staking initiative builds on the "Protocol Owned LEO" (POL) strategy outlined in an earlier tweet by Khal on July 7, 2025 (Post ID: 1943062796817588299). The POL approach involves reinvesting a portion of affiliate revenue to purchase and stake LEO tokens, creating a self-sustaining growth loop.

The flywheel effect is a key component of this model. As staked sLEO tokens earn USDC daily, those funds are reinvested to buy more LEO. Real-time tracking of this process will be available on the /leo page on LeoDex, offering transparency and engagement for $LEO holders.

Source: LeoDex

Leveraging Arbitrum for Scalability

LeoDex’s choice of the Arbitrum blockchain as its foundation is a strategic move to ensure scalability and low-cost transactions. As a Layer 2 scaling solution, Arbitrum enhances Ethereum’s performance by offloading transaction validation, a feature that has made it a favorite among cryptocurrency users. With the ability to process transactions efficiently and at a lower cost, LeoDex is well-positioned to handle the anticipated influx of stakers following the launch.

The platform’s ongoing 90-day volume-based airdrop complements the staking feature by distributing LEO tokens to users based on their trading activity. This airdrop, with a fixed reward pool, operates on a first-come, first-served basis, adding urgency and incentive for early adopters.

The introduction of LEO staking with USDC rewards challenges traditional cryptocurrency models by embedding a permanent buyer system within the protocol. This innovative approach not only rewards stakeholders but also potentially increases the value of LEO through reduced supply and increased demand. For users, the immediate benefit is clear: the opportunity to earn passive income in the form of stable USDC rewards.

With its data-driven strategy, community-focused rewards, and scalable infrastructure, LeoDex is poised to become a standout player in the decentralized finance (DeFi) space. Meanwhile, Khal and the LeoDex team have hinted at more developments to come, including regular events to boost user participation during the airdrop period. As the ecosystem expands, stakeholders are optimistic about its ability to attract a broader user base and solidify LEO’s position in the cross-chain DeFi landscape.

Now is just the right time to pack some free LEO tokens as they are still under 5 Cents. The launch of the LEO staking on LeoDex could possibly drive up the $LEO price 100x.

This is not investment advice. DYOR

Information Sources:

If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO. What is INLEO?

mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, , allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive:

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using

Comments