A Look at the Lido Protocol | The Number One Protocol for Staking Ethereum | Aug 2025

4 comments

The

protocol has been dominating staking on Ethereum. For those unfamiliar with it, it is a smart contract defi protocol that provides users to stake ETH no matter the amount they have and earn interest on their Ethereum. To run Ethereum validators users need hardware and a minimum 32 ETH staked. The LIDO protocol is facilitating the staking of Ethereum allowing everyone to get some interest on their ETH.

What is more interesting is when you stake Ethereum, you get staked tokens back in the form of stETH, then you can then use on other places, like collateral for loans, or even sell them. The initial ETH remains staked and keeps earning interest. This is what is known as liquid staking, as your funds are staked but not locked up. Bear in mind that the stETH is a totally different asset than the native ETH that is staked. Because of this, the price of stETH, although in theory pegged 1 to 1 with ETH, can deppeg and be priced lower. This has happened in the past, especially in times of distress in the markets.

More to read on the Lido protocol in their docs on the

.Here we will be looking at:

- Total value locked TVL in USD and ETH

- Daily Ethereum staked/unstaked

- Share of Lido staked Ethereum

- Lido APR on staked ETH

- Staked ETH stETH to ETH Price

- Defi protocols rank by TVL

- Price

The period that we will be looking at is 2021 - 2025.

The data here is compiled from different sources like DefiLama and Dune Analytics.

Total Value Locked [TVL]

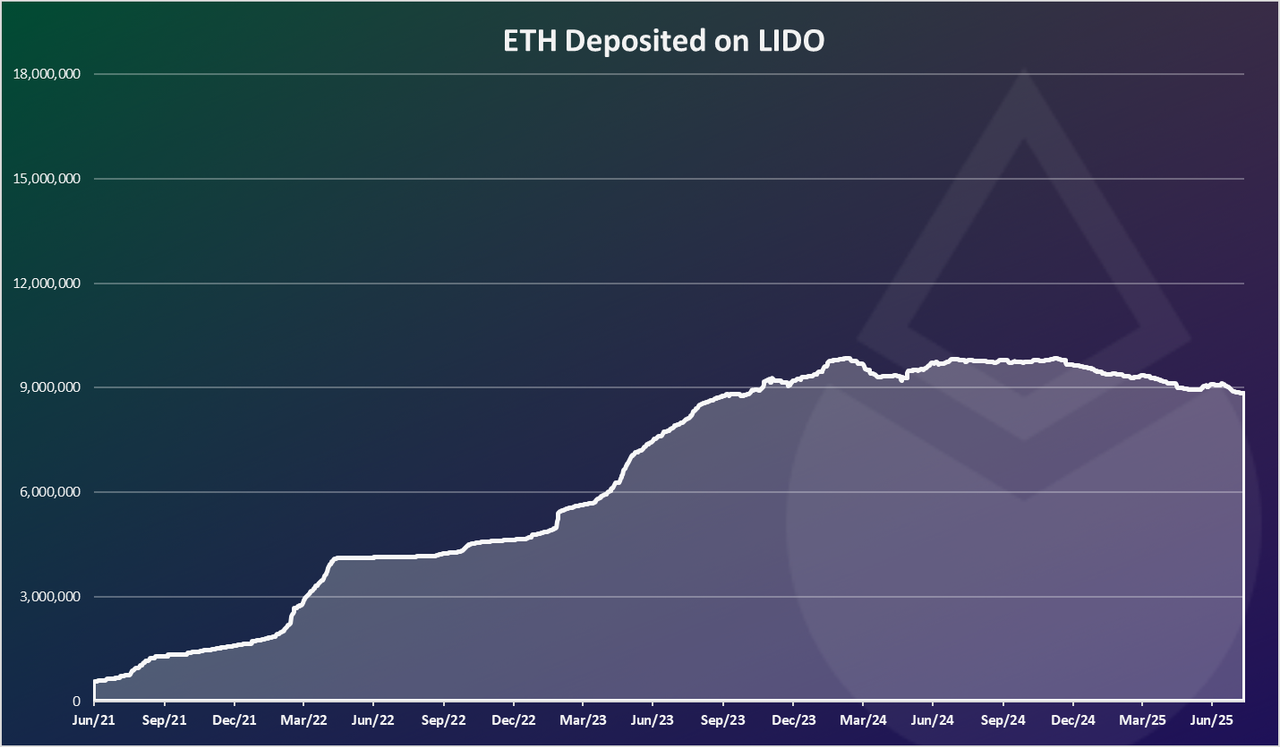

Here is the amount of ETH staked on Lido.

As we can see the amount of Ethereum staked on Lido has been going up till May 2024 and since then it has been somewhat sideways. It has reached 10M in ETH staked and since then it has been in the range of 9M to 10M, slowly going down.

At the moment there is 8.9M ETH staked on Lido.

Note that prior to May 2023, there was no option to unstake Ethereum. This option was provided after that, but the amount of staked ETH kept on growing at the time.

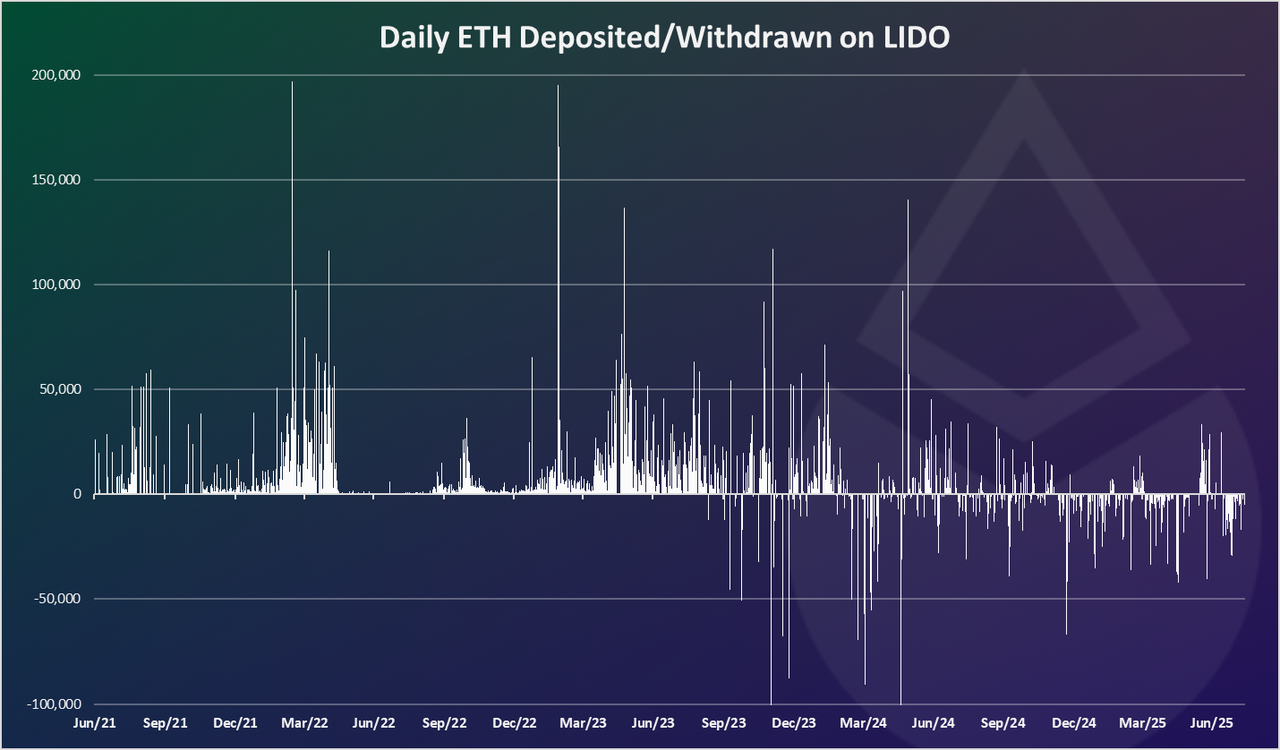

On a daily basis the chart for staking ETH looks like this:

Here again we can notice the uptrend in the first months of 2022, then a quite period after May 2022, and uptrend again in 2023.

In the last period we can notice more unstacking happening with less volatility on both sides.

In dollar terms the chart for TVL on Lido looks like this:

This chart is more dynamic than the ETH chart. This is because of the price of Ethereum that has been changing in the period.

As we can see there was a spike in the USD value deposited on Lido in the beginning of 2024 and again at the end of 2024.

At the peak there was 40B USD deposited on Lido. Just now with the rising Ethereum prices the TVL in USD on Lido has reached its previous ATH.

Share of Lido staked Ethereum

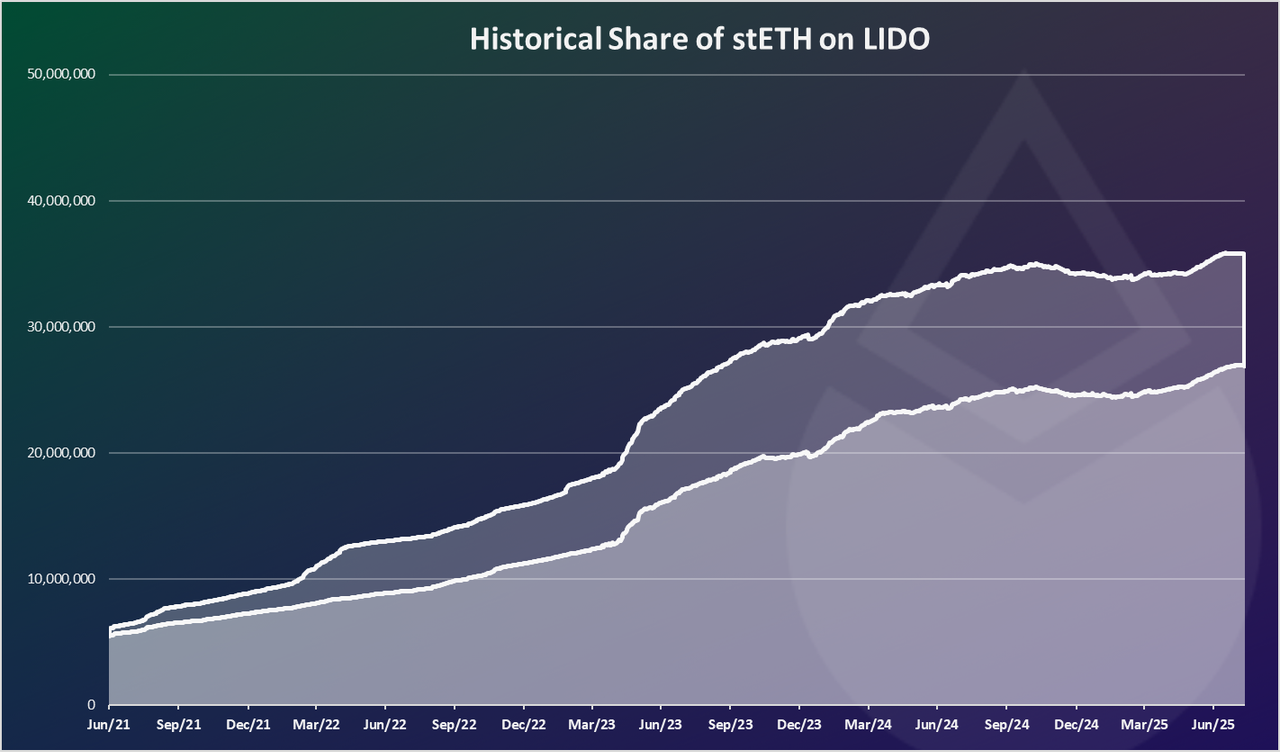

Here is the historical share of Lido from the total staked ETH.

We can notice that the amount of absolute ETH staked on Lido has been following the trend of the overall staked ETH with some small deviations from time to time.

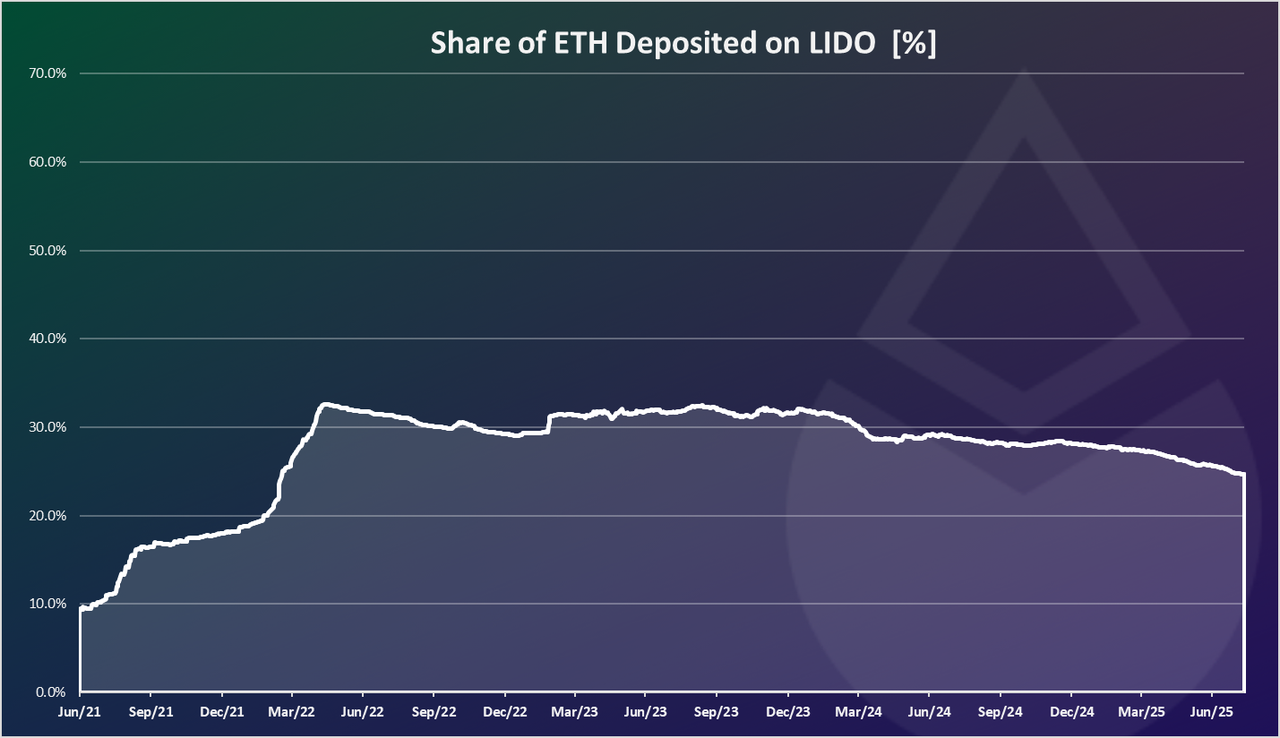

In terms of relative share as percentage % the chart looks like this:

We can see that at first the share of Lido has increased up to 33% and then more or less stayed at that level, around the 30%.

In the last period it has went down and we are now at 25%.

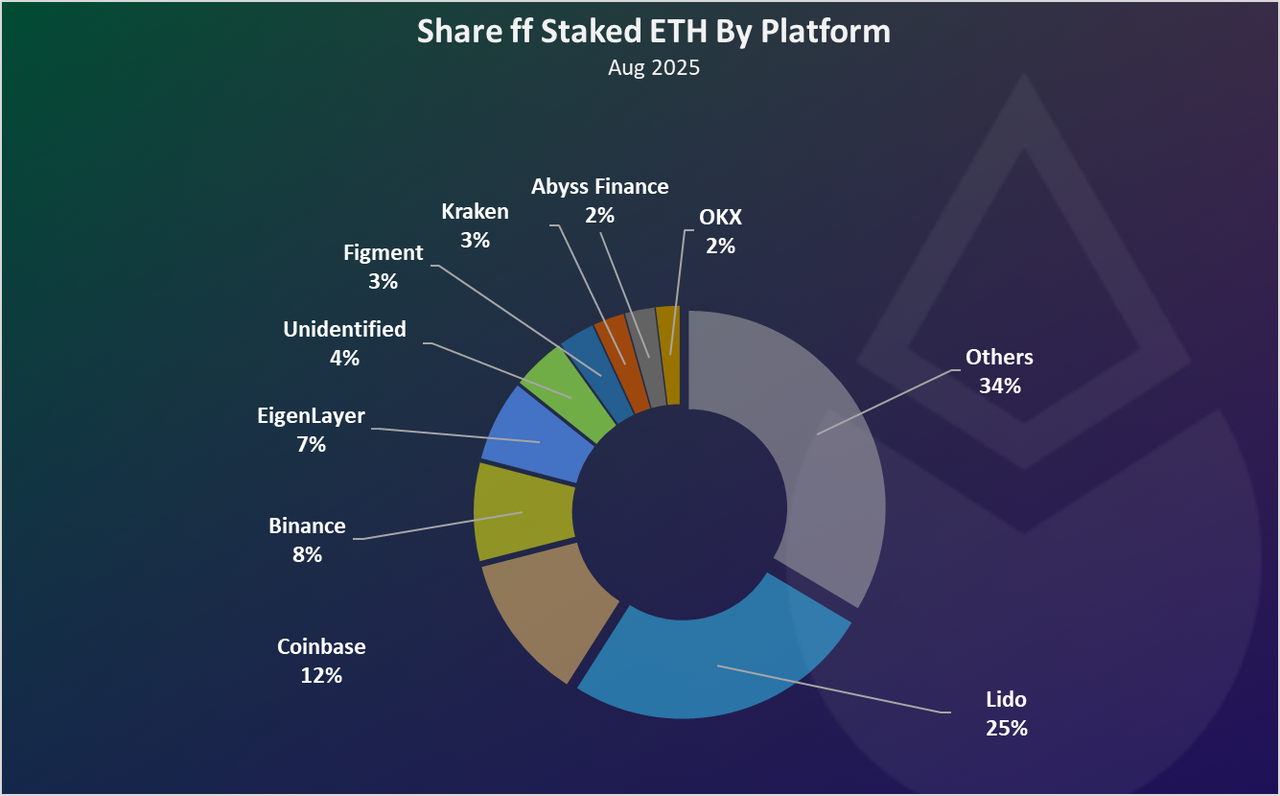

Ethereum can be staked on multiple platforms, not just Lido, and can be done directly by eligible participants. Here is the chart for the staked ETH by platform.

At the moment the share of the individual platforms looks like this:

As we can see Lido is dominating with 25% share from all the staked ETH. On the second spot is Coinbase with 12% and then comes Binance.

Some of the other DeFi staking protocols in the top like Ether.fi, EigenLayer etc.

As we can see, staking Ethereum has been consolidating in a few big pools, that has caused a reason for concern for some, as a potential threat for the decentralization of the chain.

Lido APR on Staked ETH

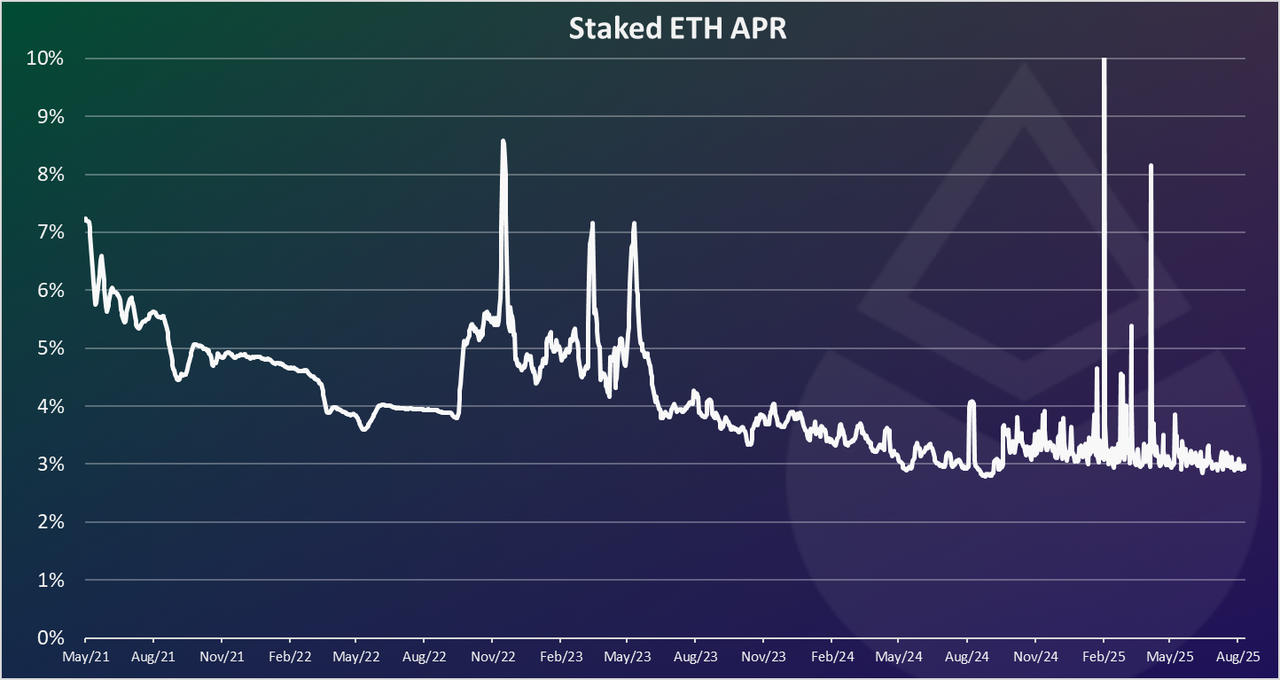

One of the most important things for Lido is what is the APR users receive on their staked ETH? Ethereum validators receive rewards from the regular inflation but also a share of the transaction fees. Because of this the APR on staked ETH is not fixed.

Here is the chart.

As we can see at times the APR on stETH has been as high as 8%, and as low as 3.%.

In the last period the APR for staked ETH on Lido has been volatile and showing signs of growth. This is in line with the smaller amounts of ETH staked recently, because as this goes lower, the APR increases.

The fees also impact the APR because share of them goes to the validators. Most of the spikes are because of increased activity in the day. In the last months the APR has stabilized around 3%.

Staked ETH stETH to ETH Price

Here is the chart.

In theory this price should be always 1, as every stETH is backed by the same amount of Ethereum. But at times the market wants instant liquidity and there can be a deppeg in the stETH price. This was especially a case in the past, when there was no unstaking option and users were locked.

Now the unstaking option is live and the peg should hold much better. As we can see there was some deppeging back in May 2022, when the crypto market crashed. At the time the ratio of stETH to ETH was at 0.95. Will be interesting to see will the peg holds going forward because as we mentioned the unstaking is now live. Overall, it has held well in the last years.

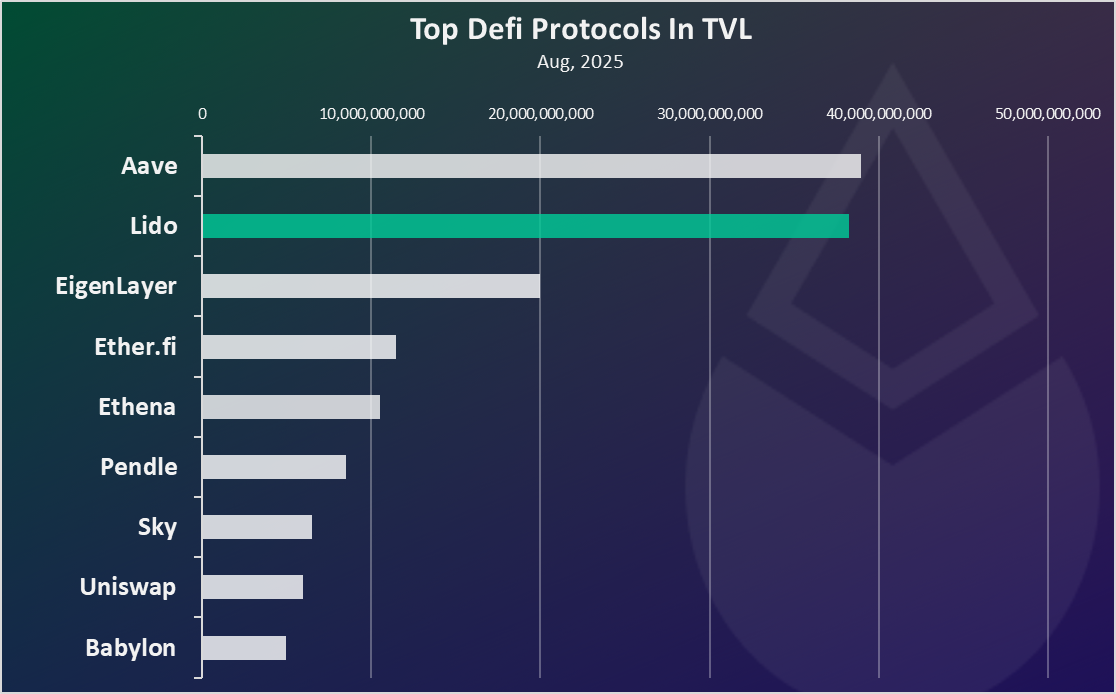

Top Defi Protocols Ranked by TVL

How is the Lido protocol doing when compared to the other ones? The total value locked is usually one of the metrics these protocols use.

Here is the chart.

Lido has been the number one protocol in TVL for a long time, but just recently AAVE has come very close to it and even overtaking it. But the difference is very small between these two, we can almost say they are currently sharing the number one spot.

Providing safe and reliable liquid staking solution has proven to be simple but powerful function to provide liquid staking for Ethereum, where users can receive APR on ETH, with no constrains on the amounts, and at the same time being able to have the stETH tokens as a liquid funds has contributed to a massive growth.

Staking Ethereum is now obviously a big business and Lido is taking a major part in it.

Price

The Lido protocol has its governance token. Here is the chart.

Some ups and downs here.

We can see that the peak was reached back in 2021 with ATH of $6 per token. Then a drop in the price going in 2022, with some occasions spikes in between. The lowest the token has been in July 2022 with a price around 50 cents.

In the last period the price of the LIDO token has grown as the price of ETH is going up as well. It is currently around 1.5 USD. Still far from its previous ATH.

All the best

@dalz

Comments