Are Global Markets Underestimating Geopolitical Risk?

3 comments

I've got to wondering why the markets have reacted with such a breezy attitude to the war in the Middle East.

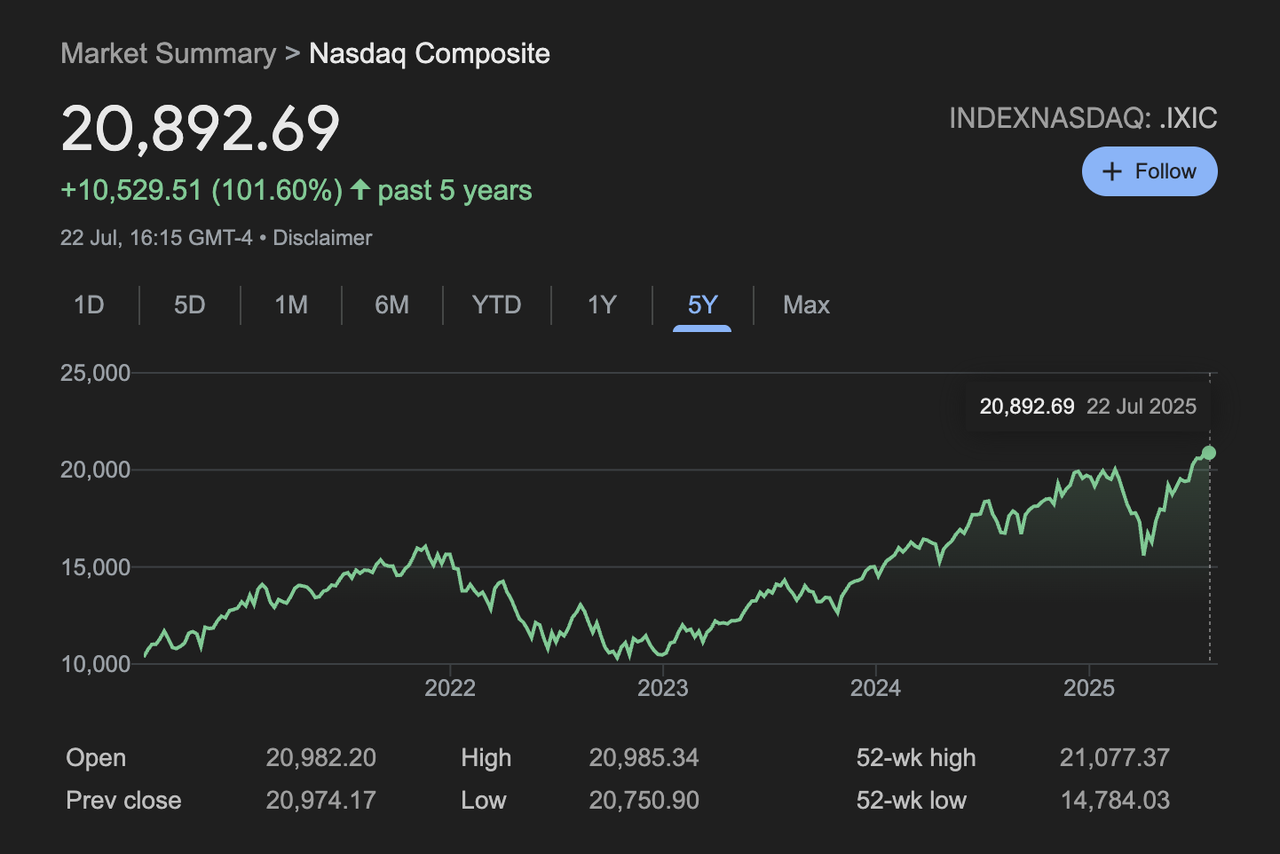

Despite the very possible risk of the conflict spreading beyond Gaza and Iran, but stock prices continue to look strong and oil isn't spiking through the roof as much as we might expect...

OK there was a dipity a few months back, but that aside, it's just been back to business as usual in recent months, onwards and upwards!

Reasons to be cautious...?

Bloomberg and others point out that investors are apt to overrespond to current events and underappreciate underlying risks to the system. Recent softness in oil prices, for instance, might be less a reflection of real-world fundamentals – supply and demand – and more the result of speculative trading and technical forces in the market. Hedge funds and money managers have a huge impact on oil futures markets, often amplifying price movement.

or maybe it is all OK, after all....?

Historical precedent has some reason to be optimistic for investors. Besides the 1973 Yom Kippup War, which released a decade of oil-induced inflation and recession in the West, other Middle East conflicts have not had a lasting mark on global markets. That has maybe conditioned investors to disregard geopolitical risk as a transient phenomenon.

Final thoughts.... Be careful in the age of radical uncertainty!

The mood across the world right now is one of "radical uncertainty," - where the future is so unpredictable that even standard risk models don't apply. The so-called "Taco trade" – a slang term for betting on Trump never to go to war – may be diverting investors from the very real possibility of perpetual economic unrest.

Israel's recent attacks on Iran is one example in a broader trend: the unravelling of settled assumptions regarding trade stability, disinflation, and international cooperation. The risk is less one of immediate catastrophe than misunderstanding how this era's hyperinterconnected crises can boom back in unanticipated forms.

Posted Using

Comments