S&P 500 Companies Reporting Amazing Reveues

4 comments

This year’s Q2 earnings season is, so far at least, a small celebration for investors! Especially in a year that began with conservative forecasts and widespread uncertainty, the results we’ve seen so far offer reasons for optimism.

THE PICTURE SO FAR

The companies we're most interested in may not have reported yet, BUT... the overall picture is very encouraging. And that’s not just a subjective impression—it’s backed by hard numbers.

We're talking about a quarter where 87% of companies that have already reported have beaten earnings expectations! Yes, 87%! For context, the historical average for EPS beats is around 81.9%. At the same time, 80.3% have surpassed revenue forecasts, compared to a five-year average of about 70%.

Let’s pause on those numbers. So far, 117 companies in the S&P 500 have reported Q2 results. Their total earnings are up +8.3% compared to the same period last year, and total revenue is up +5.3%. And all this in an economic environment that is considered transitional and full of challenges.

KEY SECTORS

But the even better news is coming from two critically important sectors: Finance and Technology. Two sectors that not only carry weight in the global economy but are also key drivers in our personal portfolios.

In the financial sector, we already have reports from over 50% of the sector’s total market cap in the S&P 500. And what do we see? Earnings are up +17.3% year-over-year! Revenues are up +5.5%. And the most impressive part? 91.2% of financial companies have beaten their EPS forecasts. Practically everyone!

In the technology sector, while Q2 results are still coming in, the outlook for Q3 is already shaping up to be very promising. Projections show earnings growth of +6.8% and revenue growth of +9.7% compared to the same quarter last year. And within this landscape, two giants stand out: Meta and Nvidia .

THE BIG PLAYERS

Meta is set to report its earnings today. Analysts expect EPS of $5.92. It’s worth noting that this estimate has been revised up +1.2% over the past week and +2.6% over the past month. This consistent upward trend in forecasts signals not just confidence, but also strong growth momentum.

Nvidia , on the other hand, will be the last of the famed “Mag 7” to report, on August 27. Expectations are for EPS of $1.60. Here too, we’re seeing increases: +0.9% over the past week and +1.8% over the past month. All signs indicate the tech titan continues to impress.

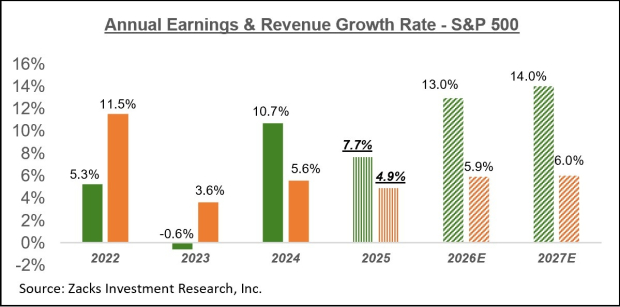

And here's something important to note: there’s a qualitative factor accompanying these numbers. The trend of estimate revisions is finally turning positive. Since the start of the year, we’ve mostly seen downward revisions. Tariff announcements by the Trump administration and other uncertainties weighed on expectations. But in Q2, the narrative began to shift. And now, forecasts for the rest of the year are climbing.

That may be the most encouraging part of all. Because it signals stabilization in the macroeconomic environment and a more positive sentiment among corporate leaders. When the very people steering the companies grow more optimistic, that means something.

Posted Using

Comments